Price Overview

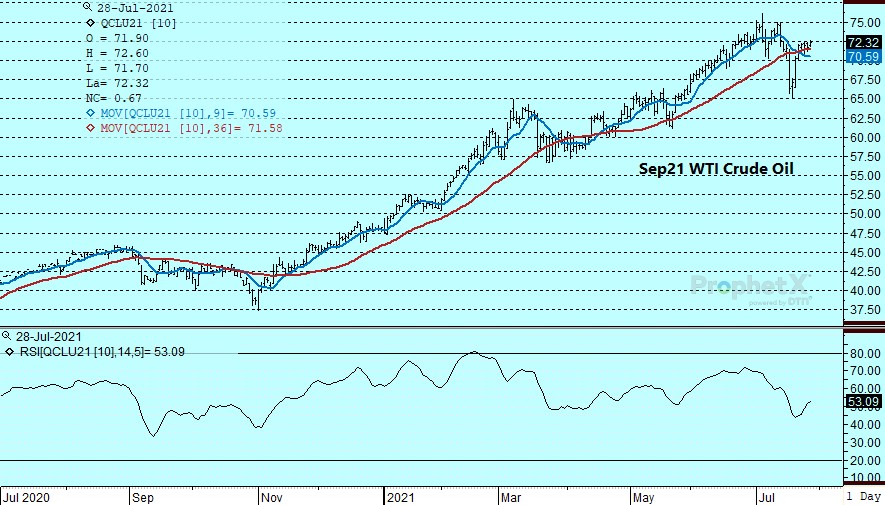

The petroleum complex traded to the upside with the DOE report providing support. Nevertheless a cautious tone prevailed as the pick-up in Covid infections and plateauing of gasoline disappearance helped inject caution into the market. Some trepidation was also apparent ahead of the conclusion of the Federal Reserve meeting today.

The IMF maintained its 6 percent global forecast for 2021, revising its forecast upward for the US and other major economies, but lowering its expectations for developing countries which are still struggling with the rise in Covid infections. For the US, growth was raised to 7.0 percent for 2021 and 4.9 percent in 2022 from 6.4 and 3.5 respectively. In India, growth was revised downward by 3 percent to 9.5 while China saw its forecast reduced by .3 percent on a scaling back of public investment and fiscal support accounting for the downward revision.

The DOE report showed crude inventories fell 4.1 mb as import levels dropped by .5 mb/d from the high levels last week. Inventories of gasoline declined by 2.3 mb while distillate declined by 3.1 against expectations for a decrease of .4 in gasoline and an increase of .4 for distillate. Domestic production of crude oil fell to 10.2 mb after reaching 10.4 last week. Total stocks of crude and products declined by 6.5 mb and stand at 1,269 mb compared to 1,454 mb a year ago. Refinery utilization was at 91.1 percent compared to 91.4 last week. Total petroleum products supplied continued near pre-Covid levels at 21.1 mb compared to 20.6 last week. and failed to validate prevailing concerns that the pick-up in infections has adversely affected disappearance particularly for diesel and jet kero.

For now we see the uncertain demand outlook offset by the prospect that stocks will decline into the end of the year, which should help confine values in a trading range of 70.00 to 77.00 until a clearer fundamental picture emerges.

Natural Gas

The market retrenched over the last two sessions as the September reached an intraday low at 3.837 today, relieving some pressure from the overbought condition of the market. Downward forecast revisions into the first week of August brought out selling interest which lead to profit taking. Prices managed to recover into the second half of the session as the September ended the day 2 ½ cents higher at 3.967. The expiration of the August contract today added volatility, as it settled at 4.044. Another surge higher in overseas LNG prices aided the bounce, as recent loadings near 10.8 bcf/d appear likely to trend higher in the coming weeks. Tomorrow’s storage report is estimated to show an injection of 43 bcf verses the 5 year average of 28. Extrapolating the step-up rally since April would point to the potential to reach the 4.40 level. The next upside target from the charts comes in the 4.60-4.80 range representing the highs in 2018. A continuation to these levels will require temperatures to trend above normal through August and LNG to regain consistent flows above 11 bcf/d. The 3.80 area continues to mark solid support on pullbacks.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.