Price Overview

The petroleum complex traded in a mixed fashion with weakness apparent in crude while product markets traded higher Flooding in China and the disruptions it might pose to supply chains along with tighter crude oil export quotas for smaller Chinese refiners known as Teapots limited fresh buying interest in crude. In addition a cautious tone prevailed over the rising rates of Covid infections in areas of Asia and the US helping raise concern over the economy and in turn demand prospects for crude oil.

The Chinese situation continues to be watched closely. The crackdown by China on the misuse of crude import quotas combined with higher prices could see China’s growth in oil imports fall to the lowest in two decades this year with forecasts suggesting growth unchanged to up 2 percent this year compared to an annual import growth rate of 9.7 percent since 2015. The flattening out of import growth comes at a time when OPEC+ plans to expand production by up to 400 tb/d between August and December. The reduction in import demand from China has forced suppliers from Brazil, Russia and Africa to divert cargoes to other areas such as Europe and the US. The lower import requirements by China might taper the demand for US crude from that area as a result particularly given the higher price levels.

The DOE report on Wednesday is expected to show a draw of 3.4 mb, In distillate, inventories are expected to increase by .3 mb, while gasoline is expected to fall by .4 mb. Refinery utilization is expected to increase by .4 percent to 91.8 percent in this week’s report.

For now the uncertain demand outlook offset by the prospect that stocks will decline into the end of the year should help confine values in a trading range of 70.00 to 77.00 range until a clearer fundamental picture emerges.

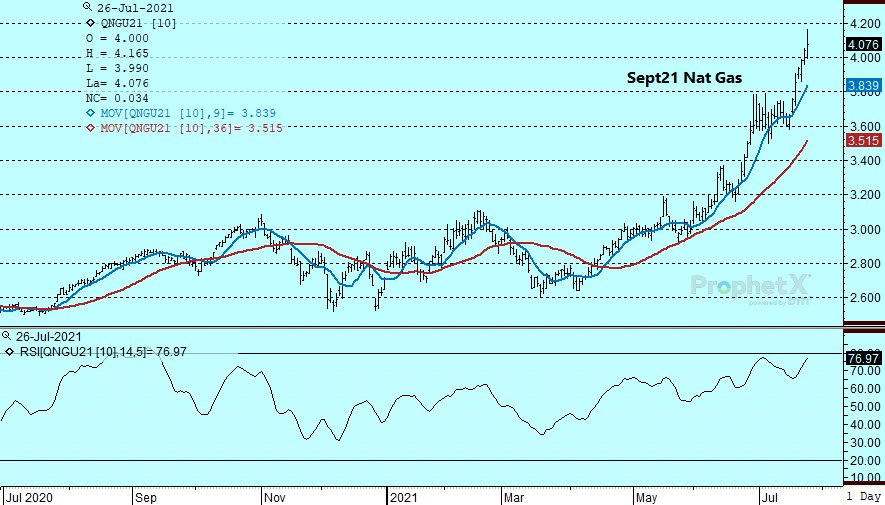

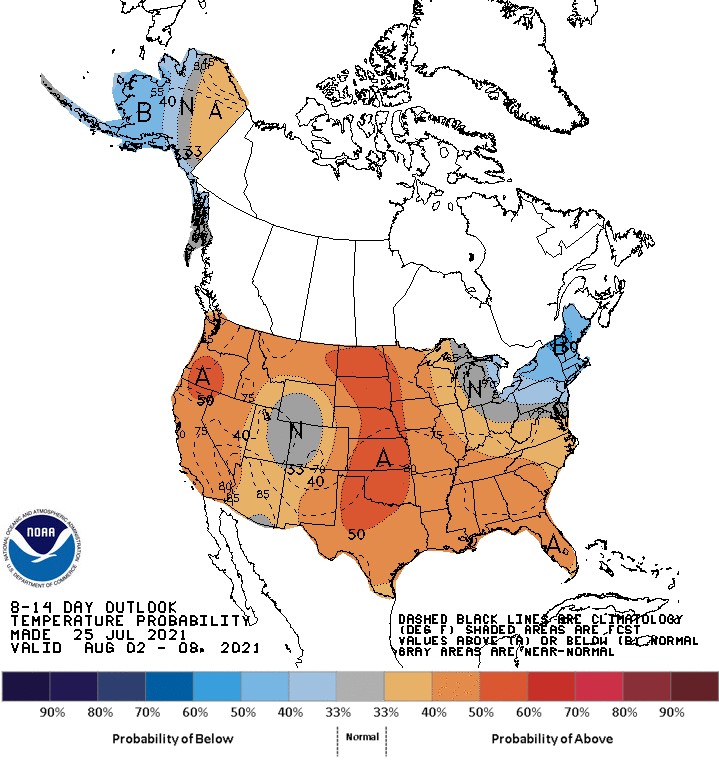

Natural Gas

Nat Gas prices pulled back from sharply higher levels but still maintained a firm tone. Strength continued to be maintained on ideas demand will increase as above normal temperatures encourage a high level of use. Some concern at the higher levels was apparent early, on the prospect for some switching from natural gas to coal given the price differential. Fears inventories will be tight at end of season continues to underpin values particularly if temps remain above normal and supports high usage at a time when production increases have been restrained and export level remain near record levels.. Weekly storage is expected at 41 bcf compared to last weeks injection of 49 bcf. US total storage is currently 5.7 percent below the 5 year average and with high export levels, pullbacks should encounter support toward the 3.80 level.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.