Price Overview

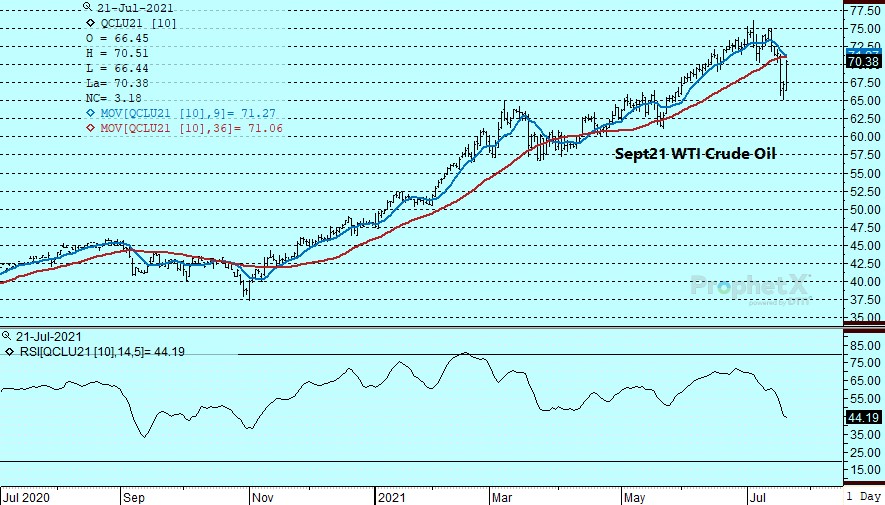

The nearby crude oil contract rallied by over 3.00 following yesterday’s unsuccessful test of the 100 day moving average near 65.00. Ideas that the market had overreacted to the OPEC agreement to phase out cuts in late 2022, along with ideas that rising infection rates in the US and Europe would ultimately create a quicker path to herd immunity as the stock market continued its recovery helped force a reconsideration of supply/demand possibilities on domestically as well as globally.

The inability to react to what was seen as a disappointing DOE report could be a response to the disciplined approach by OPEC to a reserved production policy well into 2022. The possibility that current output levels will fall short of demand over the last half of the year should provide the basis for a steadier tone despite the surge in Covid infections. The potential for the uptick in infections to lead to quicker herd immunity might also be encouraging buying along with the slow rate of capital investment in oil. Nevertheless, the market might need to confront a potentially slower pace of global growth, particularly in Asia, which is currently experiencing restrained import levels of crude.

The DOE report for the week ending July 16th showed crude inventories rising by 2.1 mb compared to expectations for a decline of 4.2 mb. Gasoline stocks fell by .1 verses expectations for a draw of 1.4. Distillate stocks fell 1.3 mb while refinery utilization fell .4 to 91.4 percent. Total petroleum stocks rose 4.4 mb while net imports of crude surged to 4.6 mb/d from 2.2 in the prior week. Product supplied at 20.6 mb remains buoyant against year ago levels of 19.6. Gasoline disappearance at 9.3 mb is above last year but below the record highs of a few weeks ago. Distillate disappearance rose to 3.9 mb compared to the depressed levels last week of 3.1 but still shy of last year at 4.0. It will be interesting to see if gasoline demand trends higher over the next few weeks given the uptick in Covid restrictions, and how much it affects mobility rates including the return to on sight work.

Look for the market encounter resistance near the 71.00-71.30 level basis September WTI given uncertainty over the economic impacts of the rise in infection rates.

Natural Gas

Prices broke out to the upside yesterday, gaining nearly 10 cents, and saw solid follow through today as the September contract settled another 8 ½ cents higher at 3.938. A gradual return of heat in the forecasts over the past few days has underpinned the move as overall demand now looks to be above normal into early August. Issues with production added support as output slipped under 91 bcf with today’s early nominations. A bounce in Mexican exports to 7.0 bcf today also remided trade of the solid setup to demand. If the warmup can continue to materialize the 4.00 level should be tested in the coming days. With the market nearing overbought territory, a retrenchment would not be surprising with the 3.80 level now becoming initial support. Tomorrow’s storage report is estimated to show a build in stocks of 44 bcf compared to the 5 year average increase of 36.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.