Price Overview

The petroleum complex came under substantial selling pressure, particularly in the nearby contracts, following news that Saudi Arabia and the United Arab Emirates had reached a compromise following a two week stand-off over base line production levels. Under the agreement the UAE will see its baseline lifted to 3.65 mb/d when the current pact expires in April of 2022, compared to 3.17 previously. The potential for increased output in the months ahead helped moderate concerns that low inventory levels would get progressively tighter had a new output deal not been reached. The possibility that other producers might request an increase was in the background adding pressure to values.

With an agreement apparently reached, the market might revert back to assessing underlying supply/demand fundamentals. Surprisingly, prices came under further pressure following the release of the DOE report. Despite the sizable draw in crude oil inventories of 7.9 mb, the market appeared to focus on the build in gasoline stocks, which were up by 1 mb, and the build in distillate inventories of 3.7, with total stocks including crude rising by 2.5 mb as other oils surged by 5.8. A sharp decline in gasoline disappearance from record highs of over 10 mb/d last week to 9.2 this week and the decline in total disappearance of all products to 19.3 mb from 21.5 also appeared to undermine sentiment. Another impressive number was the surge in exports of US crude, which rose 4.0 mb/d from an average of 3.0 over the past four weeks.

Key considerations to watch in the weeks ahead will be:

- The recovery in demand, which surged by an estimated 3.2 mb/d to 96.8 in June. The IEA continues to suggest that global oil demand will increase by 5.4 mb/d in 2021 and 3.0 in 2022, recognizing that escalating Covid cases remain a key downside risk to the forecast.

- World oil supply rising by 1.1 mb/d in June to 95.6 as OPEC+ eased output cuts. The call on OPEC+ crude oil is set to reach 42.8 in the third quarter and 44.1 mb/d in the fourth quarter compared with June production of 40.9.

- The decline in OECD stocks in June, which fell by 21.8 mb/d /d and a decline in floating storage of 23.7 mb/d, the lowest level since February of 2020. In the third quarter, stocks are expected to fall by the largest amount in over a decade which will keep crude oil balances tight.

For now, it looks like support near 70.00 basis August crude should hold, while resistance in the 75.00-75.50 range will be formidable; further declines in inventories could lead to a retest of the 76.98 high which might help encourage OPEC+ to expand production more quickly.

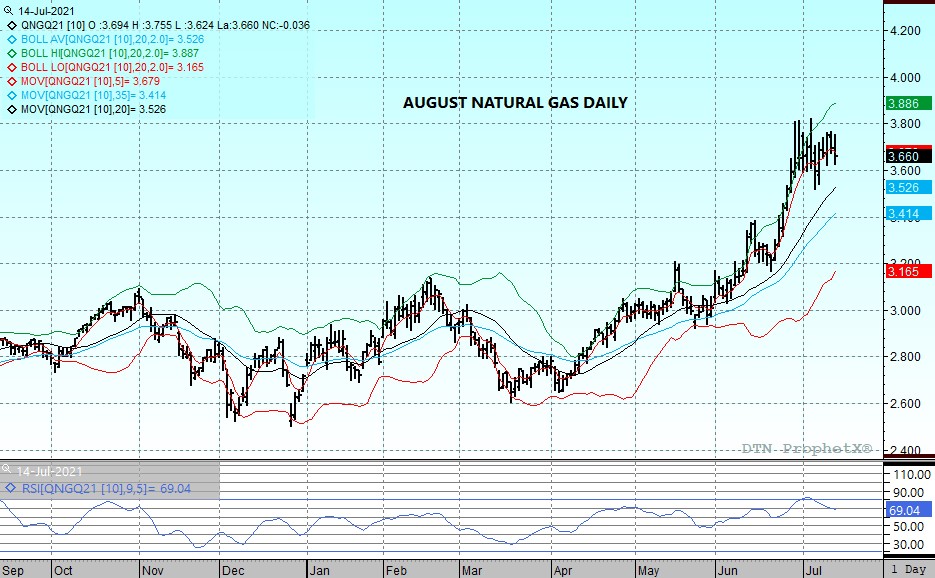

Natural Gas

Prices retrenched over the last two sessions as forecasts have offered little variation, with the 15 day models hovering near 10 year norms. The August lost 3.6 cents today to settle at 3.66 after a drop of 5 cents yesterday. Underlying support was garnered from the return of 11 bcf/d LNG flows as recent issues appear to be resolving. Production has also continued to be stagnant, with output dropping below 91 bcf the last two sessions. Despite these positives the market will have difficulty moving higher without warmer temperatures. Tomorrow’s storage report is expected to show a build of 47 bcf, which is slighty below the 5 year average of 54. Following up last weeks extremely low number, anything below the estimate likely supports the market. If temperatures can heat up there is potential to a test the 4.00 level in the coming weeks. Support on any further weakness rests just under 3.60, while the 3.49 level would likely hold up to a stronger selloff.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.