by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded higher today following early weakness linked to higher interest rates and the potential for tighter monetary policy by the Federal Reserve given inflationary trends. The ensuing strength was linked to the IEA report and growing concern over the impending cessation of SPR sales expected in October. Unconfirmed reports that the US was considering SPR purchases at prices below 80.00 added buying interest.

The IEA Monthly Report suggested that growth in demand was set to grind to a halt in the fourth quarter as the economic slowdown deepens, but indicated that a strong recovery in growth in 2023 will likely continue to strain low inventory levels. Key highlights of the report include:

- World oil production rising 790 tb/d in August, reaching 101.3 mb as a recovery in production in Libya and smaller gains in Saudi Arabia and the UAE offset losses in Nigeria, Kazakhstan, and Russia.

- Persistent demand weakness in China continues to slow the pace of refining activity which should continue to moderate into seasonal maintenance this fall, keeping product stocks tight.

- Russian exports in August higher by 220 tb/d to 7.6 mb, off only 390 tb/d from pre-war levels.

- Global observed inventories falling by 25.6 mb in July on a drawdown of crude stocks in China and afloat storage, as well as from IEA stocks. OECD stocks rose by 43.1 mb to 2,705 mb, with the deficit to the 5-year average at 274.9 mb.

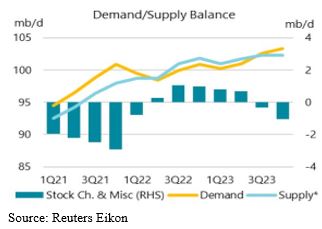

The report suggests stocks will build as we move into the last quarter of 2022 and into the first half of 2023 before drawdowns return. In addition, uncertainty persists over the impact of oil substitution for natural gas in Europe along with concerns surrounding the planned European embargo of Russian crude in December and of products in February. Of particular concern is tightness in middle distillates as limited refining capacity keeps stock levels tight.

The DOE report shifted focus to the SPR draw of 8.4 mb and the potential end of the program in October. Commercial crude stocks built by 2.4 mb, gasoline fell by 1.8, and distillate were up by an unexpectedly large 4.2 mb. Net exports of crude and products rebounded to 2.4 mb, while refinery utilization reached 91.5 percent, an increase of .6 from the prior week.

Natural Gas

The market shot higher today, racing through the 8.50 and 9 dollar resistance levels in October to settle with a gain of 83 cents at 9.114. The growing threat of a rail strike at the end of the week has fed a steady flow of buying interest as the potential inability to transport coal for power generation could lead to increased gas demand. Added pressure came from weather forecasts predicting warm temperatures across large portions of the US next week that added to the demand potential. LNG flows also reached a post-Freeport high of 11.7 bcf today, adding fuel to the already flaming fire that continues to lack the liquidity to douse moves. The upside is now void of any glaring resistance until the contract highs near 10 dollars. Any decrease in chances of a rail strike wouldn’t find decent support until the 8.50 level, and after that at the 100-day moving average near 7.90.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.