by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded higher, with the crude registering gains of $2.59 to settle at 87.91 on the December contract. The cracks traded mixed with the 2-oil gaining modestly while the gasoline crack fell. Early support to values was apparent in advance of the DOE report on strength to outside markets as the dollar and interest rates weakened on ideas the Fed might pause their tightening and await additional information on the course of inflation.

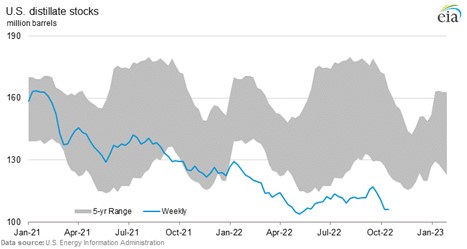

Buying interest and short covering emerged after the DOE report was released. Crude stocks fell by 1.7 mb, despite sales of 3.4 mb from the SPR. The likelihood that sales from the SPR will cease after the final 15 mb are sold, along with suggested US purchases if prices drop toward the 70.00 area, is providing background support and limiting selling interest, especially ahead of the import embargo by the EU that goes into effect on December 5th. Other key highlights of the DOE report were the decline in gasoline stocks of 1.5 mb and distillate rising marginally by .2 mb. Refinery utilization fell to 88.9 percent from 89.5 nationally, but on the East Coast rose sharply and was indicated at 102.5 percent, or above estimated capacity. Reports of short stocks of heating oil on the East Coast likely encouraged the higher throughput. Product disappearance at 20.6 remains high and for the year is showing an increase of 1.3 percent despite the increase in prices as Jet Kero and Other Oils surged. Net export levels of crude and products also surged to 3.0 mb from 1.7. Product exports totaled 6.3 mb compared to 5.3 last year.

With the OPEC cutback suggesting a contraction in availability of close to 1 mb/d in November along with the cessation of SPR sales, the market likely gets increasingly tighter just as Europe bans Russian crude imports on December 5th. While near term resistance might be provided by moderate weather for the US and Europe and a pick-up in Russian availability as the European import ban on crude draws closer, we still see the market attracting support on the low stock levels, the end of SPR sales, and as demand for middle distillates trends higher into winter.

Natural Gas

The short covering rally ran out of steam after the December contract reach an intraday high at 6.281 late yesterday. Today’s action saw an inside day on the charts as the market retrenched to end the session with a loss of 4.7 cents at 6.119. The rally was dampened by forecast revisions showing a drop in demand expectations at the back end of the 15 day outlooks. LNG flows were a minor negative influence as maintenance at Cove Point stretched out another day, although its eventual return will ad nearly .8 bcf to potential exports. Trade is also impatiently waiting for an update from Freeport, with their most recent information indicating a partial restart by mid-November. With today’s settlement through the 9-day moving average, the near term bias is higher, with a settlement above 6.28 opening up the chance for a test of the gap from mid-October at 6.772, but a sign of cooling temperatures will be needed to get the ball rolling. Any further weakness would find initial support in the 5.80 area with a failure there making 5.50 the next likely target.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.