Price Overview

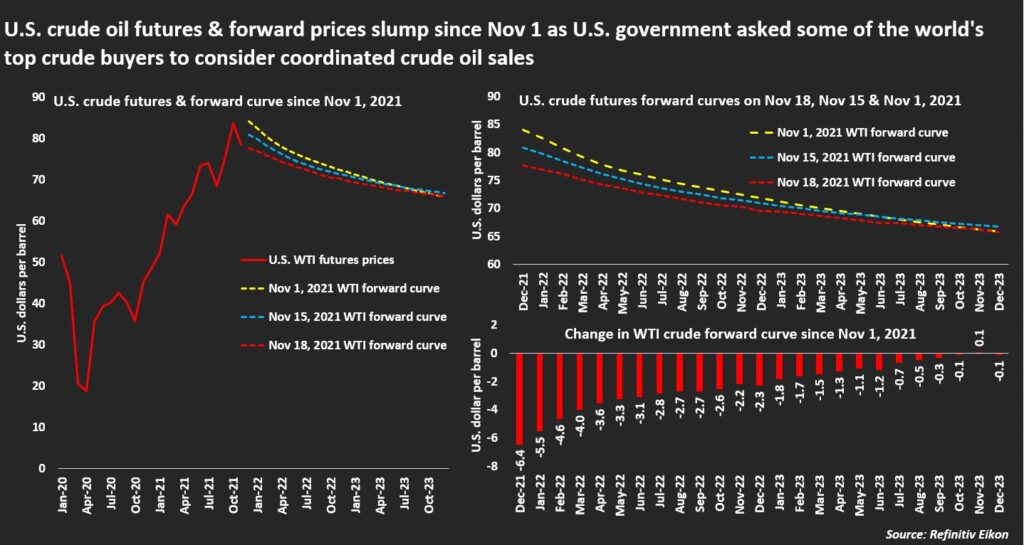

The petroleum complex traded sharply lower in response to a rise in Covid infections in Europe and the possibility of a coordinated release of Strategic Oil Reserves by China, the US and other OECD countries. The chance that additional supply could come to the market at a time when demand remains uncertain pressured values despite the current low stock levels.

The push by the Biden Administration for a coordinated release of oil stockpiles is a warning to OPEC+ to heed pleas by the US and other consumers to increase production and cool petroleum prices, which in turn could ease inflationary pressures building in major oil importers such as China, Japan Korea and India. If emergency reserves are released, its effectiveness is in question due to the likely short-term impact. Nevertheless, it is a counter to OPEC+ power, as they appear intent on maintaining their control over the oil market and supporting higher oil prices. In addition, the long-term impact is questionable given the effect on capital investment in E&P, which appeared to have turned positive due to the higher prices for 2022.

The market is in a delicate balance, with declining inventory levels offset by concerns over rising Covid infection rates. Uncertainty regarding releases from the SPR along with the restart of Iranian nuclear negotiations will be counterbalanced by the strong control OPEC+ has over production, which will be tested at their meeting on December 2nd. Prices are generally softer during the first quarter but given the recent weakness in the forward curve this might already be priced in. We continue to believe that pressure on values much below 75.00 basis January crude should be limited while resistance likely arises near the 82.00-83.00 level until a more concise reading of demand and OPEC determination on prices is received.

Natural Gas

The last two sessions saw limit price action until a late rally today pushed the active January contract to settle 15 cents higher at 5.145. The action seemed to pick up above the 5.09 area as short covering ahead of the weekend likely was to blame. Yesterday’s storage report indicated a 26 bcf build, slightly above estimates and in contrast to what would typically be the beginning of withdrawal season. The build put total stocks at 3,644 bcf, just over 2 percent below the 5-year average. Less than a month ago expectations for EOS stocks were in the 3,500 area, but a mild November has put the market in a much more comfortable position for the moment. A lack of variation to weather runs over the past two days also helped to calm prices, while LNG loadings hit 12 bcf today, which is certainly a headline grabber that likely garnered support. Offsetting the LNG glory was production, which climbed back to the 96 bcf/d area and is forecast by the EIA to continue to improve into December. The market has bounced of the 100 day moving average all week, and with the solid close and continued geopolitical turmoil overseas the path of least resistance appears to be upward. Trendline resistance off the late October/early November highs comes in near 5.30, and above there in the 5.50 area. The 100 day moving average, which is near 4.91 on the January contract, remains a key level of support, and if the market manages to settle through that area it could lead to further retrenchment.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.