by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex rose sharply, with crude registering the best gains and settling 4.44 higher at 92.61 basis December. A combination of influences attracted the buying interest as concern built over the end of SPR releases and the recognition that in their absence a substantial decline in crude inventories will likely occur. In addition, the US and G-7 sanctions going into effect on December 5th continue to attract support due to the further reduction in Russian availability. With OPEC+ calling for production cutbacks, the supply side appears tenuous at best. On the demand side, talk that the Chinese government is considering easing Covid restrictions fostered bullishness.

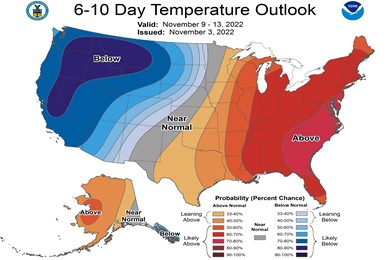

Although a contraction in economic growth might help ease inventory declines, we doubt it will be substantial and have much impact as supplies tighten into the new year and US export demand remains buoyant. Better availability from Russia ahead of the heightened sanctions might pose resistance near current levels, with the above normal 6-14 day temperature outlook in the Eastern US limiting disappearance. Nevertheless, the declines will likely be limited to the 85.50 area as questions over inventories reemerge in advance of price caps and the embargo of Russian crude oil imports by the EU on December 5th. The potential inventory declines, particularly for middle distillates, should underpin values and lead to an eventual test of the 99-101 level in the intermediate term which could help expand US crude production.

Natural Gas

The market had a minor setback yesterday before returning to its upside bias to end the week as the December closed with a gain of 42.5 cents at 6.40. The storage report showing a 107 bcf injection was well above expectations, bringing the deficit to the 5-year average down to just 135 bcf, and pressured prices lower for much of Thursday’s session. Weather models were revised considerably colder overnight and the market quickly returned to the upside track. Production continued to provide background support, as the drop to the 98 to 98.5 bcf area has been maintained for much of the week. Another day with no news from Freeport was somewhat supportive as we inch closer to their reported re-start date. With the colder potential into mid-November and the breakout on the charts, the December looks headed to fill the gap at 6.772, with resistance beyond there near 6.89, which marks a 38 percent retracement of the break since mid-September. Initial support moves up to 6.29 and below there near the 9-day moving average at 6.06.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.