by market analysts Stephen Platt and Mike McElroy

Price Overview

Volatility in the petroleum complex persisted, with values reaching above 81.00 basis January today after falling to a low of 73.60 early Monday. Although the recovery has been traced to expectations that China will loosen strict Covid controls, we suspect other factors are at work, such as the price cap on Russian crude oil and embargo effective December 5th. Additional support has emanated from ideas that the chance of a recession in the US is declining as interest rates begin to stabilize and the dollar weakens. Another factor is the limited spare capacity among OPEC members. Their over-compliance with production cuts is unlikely to get better given the limits on Russian availability not only in the short term but longer term as well. OPEC sustainable production capacity also remains limited as supply chain issues persist, while in the US production increases are likely to be modest.

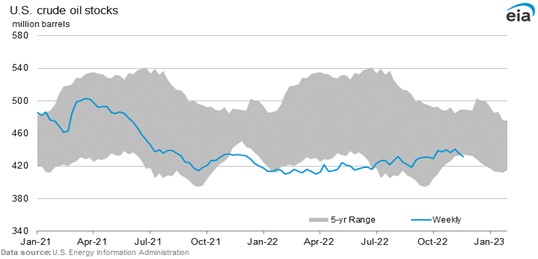

Today’s DOE report provided little indication that the supply-demand situation will get better. The release showed a sizable draw in commercial crude inventories of 12.6 mb, as an increase in refinery utilization and high export levels of crude and products continue to tax available supplies. Higher refinery rates at 95.2 percent compared to 93.9 last week and 88.8 last year helped ease supply tightness in products, as distillate rose by 3.5 mb and gasoline was up 2.8, but the high level of crude draws suggests that either a marked increase in supply or a radical reduction in disappearance levels needs to occur.

Even a limited restriction on US export levels might be considered if the overall decline in stock levels cannot be stabilized. The OPEC+ virtual meeting is unlikely to change the market dynamics given strong signs that the current agreement will be rolled over, leaving only a slowdown in the US and world economy to balance supply-demand prospects as we enter 2023. This appears unlikely as China eases Covid lockdowns and the US slows interest rate increases.

Natural Gas

The market traded sideways yesterday and into the first half of the session today before breaking below the 7 dollar level and rooting out stop orders, ending with a loss of 30.5 cents at 6.93. Momentum seemed to come from action in the House to pass a bill to prevent a rail strike, which would likely have driven natural gas prices higher as coal availability would have been hampered. Adding to the negative bias were production levels maintaining 100 bcf/d and minor decreases in demand expectations from the weather forecasts. Tomorrow’s storage report is expected to show an 84 bcf withdrawal, compared to the 5-year averge pull of 34, and should offer underlying support as the deficit to the 5-year average continues to increase. Today’s settlement back below the 9-day moving average is a negative near term development, with the lows today near 6.80 marking key support on a settlement basis. A swing in momentum to the upside will find initial resistance in the 7.17-7.20 range and beyond there the market won’t find much to slow it until the 100-day moving average near 7.70.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.