by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continued to trade in a volatile fashion with prices recovering strongly since the blow off low reached early Thursday at 63.64. The June crude ended the session with a gain of $2.78 at 71.34. Although concerns over the mixed pace of China’s recovery and whether the US will fall into recession remain in the background, the weakness appears to have finally attracted buying interest on a tightening stock situation and more neutral US Federal Reserve language that gave traders pause over how extensive the downside risk might be. Some of the support was associated with improvement in the 2-oil crack, which has shown a stronger trend over the past week after recent weakness traced to declining freight volumes. Key to the outlook will be the RBOB crack, where lackluster demand has been apparent ahead of summer.

Recent weakness appears to have run its course for now, and the market will need time to consolidate and assess Russian availability and OPEC cuts against a possible economic contraction and a potentially tighter stock situation into summer. The 100-day and 20-day moving averages on June crude are at 76.75 and 77.13 respectively and will pose resistance to the upside.

Concern over the US economy will remain a headwind until after the FOMC meeting this week. In the absence of a major move by the Fed to raise rates beyond the 25 basis points expected and a failure to resolve the debt limit impasse, look for economic concerns and Russian availability to be pushed into the background. Additional fiscal stimulus from the Infrastructure and Inflation Reduction Act should provide stimulus to the US economy and provide support down toward the 73.00 level basis June crude. This would help underpin a recovery in the latter half of the year on growing tightness in crude inventory levels, particularly if the recovery in the Chinese economy develops and bolsters Asian demand.

Natural Gas

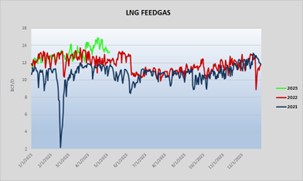

Prices managed to eke out minor gains today, but not before probing out a new low for the fourth straight session. The June contract traded down to 2.031 intraday before settling with a gain of 3.6 cents at 2.137. Buying interest emanated from short covering into the weekend after losses of over 30 cents since the beginning of the week. The persistent weakness continues to be traced to the combination of steadily increasing production with decreased LNG flows due to seasonal maintenance as seen in the graphics below. With weather expected to normalize into the middle of the month, look for the market to continue to flounder and search for a low until we get into June and the potential for cooling demand increases. Yesterday’s storage report showed a small improvement to the storage overhang, with the 54 bcf build well below the 5-year average at 87. Support is maintained at the psychological 2-dollar level, with a move below there finding support near 1.94. Further weakness would target a test of the 1.80 area, which marks the lows on the weekly charts from September 2020. Initial resistance is at the 9-day moving average near 2.37.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.