by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded sharply higher in response to growing concerns over tightening availability from Russia. Reports that the European Union was considering a phase out of Russian oil imports within six months, while refined products will be banned by the end of the year, encouraged the bullish tone. Although requests for exemption from Hungary and Slovakia are likely, the signs of wider action by the EU are fostering expectations that more active buying of physicals will occur as a precaution, pushing forward demand. Although concerns over the Chinese economy remain along with higher interest rates in the US following the move by the Fed today, the low level of product stocks and expectations of further tightness are limiting downside pressure.

Today’s DOE report showed a build in commercial crude inventories of 1.3 mb as the SPR continued to be drawn down, this week by 3.1 mb. Cushing stocks built by 1.3 mb to stand at 28.8 mb. Gasoline stocks declined by 2.2 mb while distillates were lower by 2.3. Total stocks including the SPR fell by .5 mb as propane and other oils rose by 1.6 and 3.7 mb respectively. Refinery utilization surprisingly fell 1.9 to 88.4 percent despite the prevailing high margins. Net export levels for crude and products totaled 837 tb/d with net product exports reaching 3.6 mb/d compared to 2.7 last year.

Reports that OPEC+ sees a bigger 2022 surplus were generally ignored. They stated that the excess will reach as high as 1.9 mb/d. It was treated skeptically given the appearance that they will continue to maintain their measured approach to production increases and not risk alienating Russia. With over-compliance levels high, relief from supply tightness will not come from OPEC any time soon, keeping supply availability tight.

We still see the potential for values to recover toward the 115 area on WTI in the absence of any radical change in OPEC policy or an agreement to lift sanctions against Iran. The best chance at reducing demand significantly could come from higher product prices as margins continue to expand relative to crude.

Natural Gas

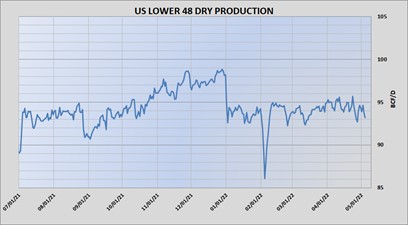

The push through 8 dollars happened a little faster than expected, as prices tested the April highs yesterday and then shot quickly through those levels today to end the session with a gain of 46 cents to 8.415. The confluence of issues remains the same, with lackluster production being the primary cause of concern in the face of low current stocks, a potentially hot summer and imminent sanctions on Russian oil due to the war in Ukraine causing concern that gas could be next. Warm temperatures expected in the next 10 days in portions of the US will push CDD’s (Cooling Degree Days) well above normal, which added to the bull case. You have to look to a monthly chart to find any potential resistance targets, with rallies in November of 2004 and 2006 stalled near the 9 dollar level. There are increasing mentions in industry chatter of the 10 dollar handle this summer as volatility is likely to remain high for the forseeable future. The rapid rally again opens up the potential for sizeable pullbacks, with the 8.00 area now initial support. Tomorrow’s storage report is expected to show a 68 bcf injection comparet to the 5 year average build of 78.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.