Price Overview

The petroleum complex traded mixed before the crude oil finished at unchanged levels and the products managed small gains. Early buying was linked to the API report that showed crude stocks drawn down by 439 tb, gasoline off 2 mb and distillate down 5.1 mb. Resistance developed above the 66.00 area basis July on the potential return of Iranian oil to the marketplace, which could increase supplies by 1-2 mb/d. The selling appeared to be linked to comments from an Iranian spokesman suggesting that he was optimistic regarding Tehran reaching agreement soon at talks with world powers aimed at reviving a 2015 nuclear deal, even though serious issues still need to be resolved. The market also found support on statements by the Russian oil minister suggesting the market is in deficit by as much as 1 mb/d. The comments generated some caution given the Russians’ desire to follow through on a production increase at the ministerial conference on June 1st. Whether the supply target will be adjusted to accommodate additional barrels from Iran remains to be seen given the uncertain demand environment and the appearance that prices are at satisfactory levels to encourage capital investment.

The DOE report released today was supportive, as the decline in crude inventories of 3.3 mb (including the SPR) was larger than expected, while gasoline stocks were lower by 1.7 mb and distillates were down 3.0. Disappearance for all products was impressive at 20.0 mb as gasoline and distillate use picks up with mobility and economic activity expansion.

We still expect the approach of the June 1st Ministerial meeting to confine values to a trading range between 62.00-66.00 per barrel basis July WTI.

Natural Gas

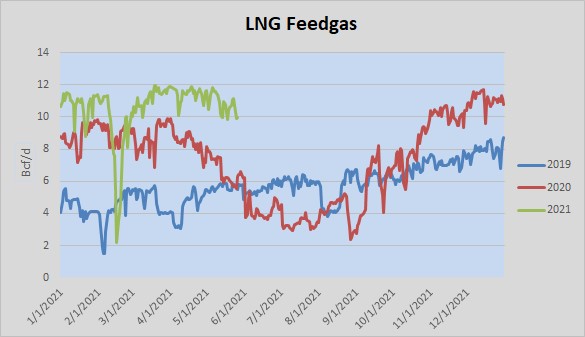

The market managed to recover the losses from early in the week as the July settled at 3.027, up 5 cents on the day and 12 cents above Monday’s low. This put prices back into the upper end of the early May range after weather fluctuations had tossed us through a 30-cent swing in the matter of a week. Stubbornly decreased LNG flows have kept downside pressure on the market, with maintenance and other temporary issues keeping loadings well under 11 bcf/d for much of the last two weeks. With overseas LNG prices continuing to trend upward and European storage levels depleted, the future still looks bright for exports through the remainder of the year as the current slowdowns may simply be in preparation for an active summer. Tomorrow’s weekly storage report is expected to show a build of 104 bcf compared to the 5-year average increase of 91. This has likely added some caution on the upside as well. If correct, it would still leave total stocks 3 percent below the 5-year average. The solid recovery from Monday’s lows makes the 2.90 level an important support area as we finish up May. Initial resistance in the 3.05 area held up today, and a violation of that level will be contingent upon warmer temperatures returning to the forecast and the recovery of LNG flows back above 11 bcf/d.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.