by market analysts Stephen Platt and Mike McElroy

Price Overview

Crude oil recovered from early losses to close 85 cents higher at 77.72 basis July, with the backwardation firming sharply. A rise in equity values helped reverse weakness linked to ideas a fed interest rate cut was unlikely until September at the earliest. Buying developed at the lower levels on ideas the market was oversold given the approach of the OPEC meeting, attacks by Houthis on ships in the Red Sea and Mediterranean, pessimism over the chances for a ceasefire in Gaza, and the potential for a strong recovery in gasoline demand into the summer.

OPEC+ pushed back its meeting by one day to June 2nd and moved it online. It was originally scheduled in Vienna on June 1st. Sources have reported that voluntary cuts totaling 2.2 mb/d will be rolled over. The amounts are on top of earlier reductions of 3.66 mb/d in force until the end of 2024 and announced in various tranches since 2022. The actions have been in response to expanding production in the US and other non-OPEC countries resulting in a declining market share for OPEC. In addition, demand concerns linked to rising EV use and slower than expected economic growth in China remain in the background as limiting factors.

Interest rate policy will be a key consideration as we move through the summer given its potential to impact the dollar and economic growth. In the near term, ample supply availability has been seen despite OPEC+ pledges to maintain a balanced market. The increase in refinery throughput in the US should provide background support to values as summer driving picks up. The OPEC+ meeting will also be an important bellwether, with the loss of market share a source of concern along with surplus capacity totaling up to 4 mb/d. Some producers are reluctant to carryover current cuts despite statements suggesting that they are united in attempting to balance the market. How the discussions play out will be a barometer of how unified the group is despite losses of market share in China and India and competition from expanding output of non-OPEC producers.

Natural Gas

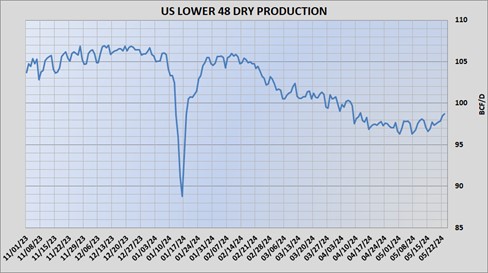

The market retrenched to end the week, with the rally stalling out in the wake of yesterday’s storage report. The number was somewhat bullish, coming in at a 78 bcf build and below estimates near 85. A new high for the move had been reached Thursday morning, and after attempting to retest that area immediately after the report, the rally failed and prices began to trend lower. A 13 cent loss yesterday was followed up with an additional 15 cent drop today as the July ended the week at 2.773. The weakness initiated a wave of profit-taking ahead of the long holiday weekend as the RSI had reached overbought levels above 80 percent, and aided by improved production, which reached the 98.5 bcf area the last two days. The pullback retraced 38 percent of the May rally and also dropped back below the 200 and 9-day moving averages. The next level of support is near 2.71 which would achieve a 50 percent retracemtent of the May rally. Resistance will be scattered until the psychological 3 dollar level, with a settlement above there necessary to reignite the rally.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.