Price Overview

The petroleum complex continued to attract good buying interest following statements by US Secretary of State Blinken on Sunday indicating that the US had not seen Iran move to comply with its nuclear commitments in order to have sanctions removed, despite the progress of ongoing talks. Goldman Sachs continues to suggest Brent oil prices will reach 80.00 per barrel in the fourth quarter based on expectations for a rebound in demand, despite the potential restart of Iranian exports in July. The investment banker suggests that OPEC+ could move to offset Iranian increases by halting a ramp up in production by its members for two months. Some nervousness was also apparent in response to the Iranian decision to extend for a month an IAEA monitoring deal that had expired.

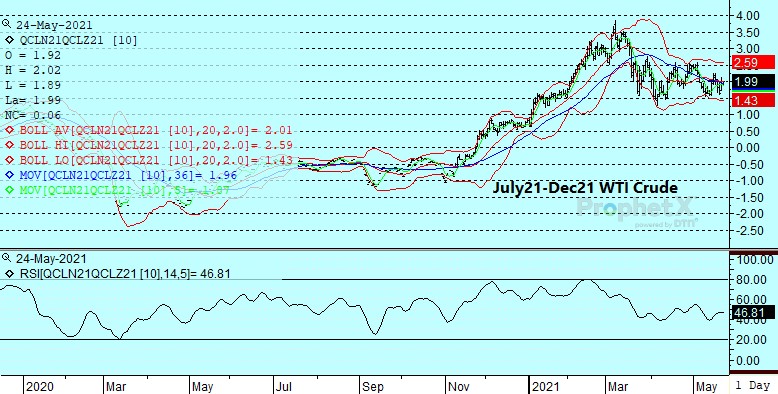

The approach of the June 1st Ministerial meeting is likely to confine values to a trading range between 62.00-66.00 per barrel basis July WTI. A key barometer on the course of values might be the intra-market spread of July-December crude, which is currently near 2.00 premium July. This spread has been confined to a range of 1.40-2.60 since early April. A breakdown below 1.40 would likely reflect declining hopes for a fast recovery in demand due to the failure to quell the virus in areas outside the OECD, while a disciplined OPEC+ production policy and strong recovery in global demand could force the spread back through the 2.60 area.

Expectations for Wednesday’s weekly storage report point to a 1.3 mb decline in crude oil stocks, a .8 mb drop in gasoline and distillates of 1.9. Utilization us expected to pick up minimally to 86.4 percent.

Natural Gas

Prices gapped on the Sunday night re-open again, only this time to the downside as weather revisions indicated significant demand loss that sparked selling interest. The July was pushed down to an intraday low at 2.903, which extended the retracement of the April/May rally to 50 percent. A gradual recovery as the day wore on left the July 2 cents lower at 2.96 to end the session. With a build in excess of 100 bcf expected on Thursday, the loss of potential demand in the coming weeks eased concern over storage levels and raised the possibility that stockpiles are back to average before summer. Production also bounced over the weekend, reaching near 92 bcf/d, and added to the negative tone to start the week. The solid recovery off the lows today makes the 2.90 level an important support area as we finish up May with cooler expectations compared to a week ago. Initial resistance should emerge in the 3.05 area if we can mount a recovery, which will be contingent upon warmer temperatures returning to the forecast and the recovery of LNG flows after two weeks of maintenance related slowing.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.