by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded on both sides of unchanged but finished mostly higher, with July crude up 36 cents at 72.05, while gasoline continued to show greater strength ahead of the summer driving season and on low stocks, gaining 3.94 cents to 253.71. ULSD was moderately higher, settling at 235.89. Caution ahead of US debt ceiling talks tended to offset a bullish outlook based on improving demand prospects amid production constraints.

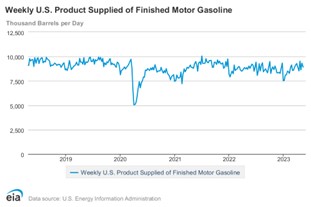

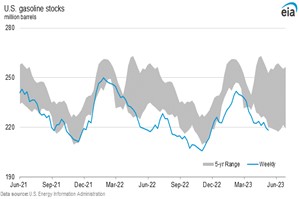

Strength to the gasoline crack has been apparent since the beginning of May, with values advancing steadily from near the 27.00 level to as high as 34.50 today. Concern over low stock levels has been apparent despite increases in refining activity. The strength likely reflects optimism that summer travel by car will be strong as pent-up demand and some reluctance to fly encourages vacations within driving distance. While disappearance levels have been rather mediocre in advance of the summer, we suspect it will pick up dramatically over the next few weeks to underpin the cracks despite ongoing economic concerns.

The DOE report on Wednesday is expected to show crude and distillate stocks gaining .5 mb, with gasoline predicted to be lower by 1.1. Refinery utilization is estimated to increase by .7 to 92.7 percent.

Natural Gas

The market gave back most of its gains from late last week as the active July contract lost 15.6 cents to settle at 2.551. The pullback was traced to the overdone levels of the rally after Thursday’s storage report and unimpressive weather expectations into early June as trade may have been assuming that heat was on the way. Production was also a negative influence as weekend output crept back toward 102 bcf/d. LNG loadings showed signs of recovery, bumping above 13 bcf and offered underlying support. The retrenchment stalled at the 9-day moving average which came in near 2.52 today. That area now offers key support on a settlement basis, with a violation possibly spurring a retest of the lows. A return to positive trade will not find resistance until the 2.70 area

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.