by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continued to trade in a choppy fashion, finishing with modest losses in crude and ULSD but higher in prompt gasoline. Decreasing economic concerns linked to optimism over a deal on the US debt ceiling provided underlying support but the course of interest rates remains a source of uncertainty, creating caution on the long side.

Of importance has been the recognition that the supply/demand balance will get increasingly tighter as we move into the second half of the year. In the background were production disruptions in Alberta, Canada due to forest fires along with disruptions to Kurdish exports to Ceyhan. Chinese refinery throughput rose sharply in April by 18.9 percent, which deflected attention from weaker than expected retail sales and industrial production.

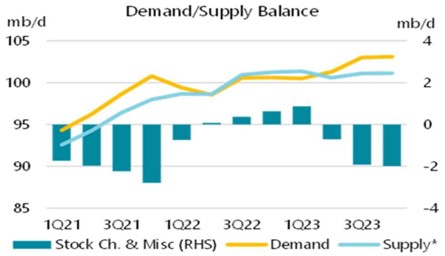

The market is now focusing on the potential for lower crude inventories as we move through summer. In addition, tightening sanctions on Russia might impact sales, which have reached record levels to China and India. While worries over economic growth remain in the background the prospect for a tighter market as suggested in the International Energy Agency Monthly Report remains a key consideration for prices. The IEA said that demand might eclipse supply by up to 2 mb/d in the second half of 2023 as OPEC+ supply cuts take effect in May and demand for gasoline rises seasonally.

For now, economic concerns will be a headwind to prices, but the likelihood of gasoline disappearance recovering into the summer along with Chinese stimulus should help underpin a tighter stock situation, which will be magnified if purchases to rebuild the SPR occur later this year. Production shortfalls and improving demand suggest that downside potential is limited. Look for a retest of the 74.00 area near term, and potentially the 100-day moving average near 76.50 as concern over raising the debt limit runs its course in the US. If a 2 mb/d deficit in global inventories in the second half is realized and the US avoids a recession, a move toward the 90-dollar area cannot be ruled out.

Natural Gas

A bullish surprise from yesterday’s storage report reignited upward momentum, as the June contract pushed through the 2.50 resistance area to settle at 2.592. Early action today saw a high reached at 2.685 before prices pulled back to end with a small loss at 2.585. The 99 bcf injection was below expectations at 108 and shook up the market’s assumption that there would be a string of triple digit builds in the coming weeks. The miss was attributed to poor wind generation and decreased supplies from Canada due to wildfires. Prices pulled back today following the Baker Hughes release, which showed gas rigs unchanged from last week. The 10-cent move was excessive and appeared to be algo traders looking to stir up volatility. The highs today marked a 50 percent retracement of the break since early March and offer initial resistance on follow-through attempts. Beyond there the 100-day moving average near 2.81 would be the next target. Initial support now moves to 2.50, and then at the 9-day moving average of 2.35.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.