by Stephen Platt and Mike McElroy

Price Overview

June crude oil reached our long-standing intermediate term objective of 115.00 and continues to find resistance above that level as Europe faces opposition from Hungary on enacting a Russian oil embargo. Although hope that a summit on May 30-31st will change the Hungarian veto, it remains uncertain whether a phased in ban will be adopted. In the background are statements by Fed Chairman Powell suggesting that their focus on containing inflation will lead to further interest rate increases in the months ahead. Neither the DOE report nor the appearance that China is moving out of lockdowns appeared to support values.

The DOE report showed commercial crude inventories falling 3.4 mb despite 5 mb coming out of the SPR. Gasoline stocks were lower by 4.8 mb while distillate inventories rose by 1.2. Cushing stocks fell to 25.8, off 2.4 mb from the prior week and compared to 45.8 last year. Domestic crude production rose to 11.9 mb compared to 11.8 last week while net exports of crude and products totaled 1 mb compared to net imports of .5 mb last year. Total products supplied reached 19.7 mb, an increase of .4, with gasoline accounting for the bulk of the increase as it gained .3 to 9 mb but was below last year’s level of 9.2.

Of particular interest was the sharper than expected increase in refinery utilization to 91.8% from 90.0% last week. The high margins recently for both gasoline and diesel have kept refinery maintenance limited and appear to finally be encouraging refinery throughput. In addition, the heavier oil offered through the SPR is encouraging production of distillates. Subsequently, the 2-oil crack has pulled back significantly from the highs seen earlier this month near $59.00 per barrel to $43.00 today. The weakness might foreshadow some change in sentiment from pronounced tightness in diesel to a more balanced situation could be providing resistance to crude in the 115.00 area. Support appears to be between 102-104 basis July.

Natural Gas

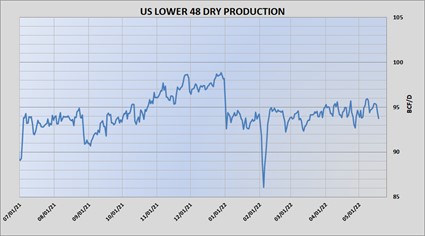

The uptrend has remained in place with a new high put in for the sixth straight session. The active June contract peaked at 8.548 before settling at 8.368 for a gain of 6.4 cents on the day. Support continues to be provided by warm temperatures and stalled production. After a weekend uptick, output has pulled back under 95 bcf/d as the 300 plus bcf deficit to the 5 year average looks likely to be maintained into mid-summer. As the chart (right) shows US production has seen no meaningful improvement this year. Add to that the rebound in LNG flows, indicated at 12.9 bcf today, and the upward bias appears justified. The wave of selling seen mid-session was likely spillover from the sharp selloff in equities as recession concerns build, but it ultimately had more effect on the petroleum sector than gas. Tomorrow’s storage report is expected to show a build near 87 which is in line with the five year average. Until production shows consistent growth the path of least resistance remains higher, with 8.75 offering minor risistance and beyond that there is little in the way of a move to the highs near 9 dollars. Pullbacks should find support at 8.00 and below there near 7.75.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.