by market analysts Stephen Platt and Mike McElroy

Price Overview

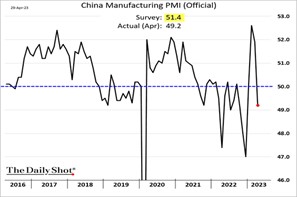

The petroleum complex gave back some of the strong gains evident on Friday, with crude closing 1.12 lower at 75.66. Concurrent but opposite themes of a weakening global economy and possible tightening supplies tied to OPEC+ production cuts have contributed to the choppy trade. Of concern today was the surprise contraction in China’s Purchasing Manager’s Index, which declined to 49.2 in April from 51.9 in March, with the 50-level that separates expansion from contraction violated for the first time since December. A key area of decline was export orders, which fell to 47.6 from 50.4 in March. The primary driver of growth in the economy during the first quarter was retail spending following the lifting of COVID restrictions.

The recovery of the Chinese economy will be a linchpin for crude oil market dynamics. Given the recent declines in freight rates, support for the export sector might transpire. However, tense US-China relations and US moves to locally source output remains a future drag on their export potential. Additional monetary stimulus by Chinese authorities would help revive other sectors, particularly infrastructure and construction, and would aid in moderating overall trends.

Concern over the US economy will remain a headwind until after the FOMC meeting this week. In the absence of a major move by the Fed to raise rates beyond the 25 basis points expected and a failure to resolve the debt limit impasse, look for economic concerns and Russian availability to be pushed into the background. Additional fiscal stimulus from the Infrastructure and Inflation Reduction Act should provide stimulus to the US economy and provide support down toward the 73.00 level basis June crude. This would help underpin a recovery in the latter half of the year on growing tightness in crude inventory levels, particularly if the recovery in the Chinese economy develops and bolsters Asian demand.

Natural Gas

Prices remained constrained within April’s tight range as the June contract had an inside day on the charts, settling at 2.318 for a loss of 9.2 cents. Record production levels over the weekend that reached above 102.7 bcf/d put the market on the defensive, while rotating maintenance at LNG facilities kept loadings well below 14 bcf/d and added to the weak bias. Underlying support was offered by current cool temperatures across much of the US, which are likely to lead to below average inventory builds this week and next to take a small bite out of the current storage overhang. The 2.20 area remains initial support with a move below there likely leading to a test of the contract lows near 2.14. Any recovery in prices will find initial resistance in the 2.36-2.39 range, which encompasses the 9 and 20-day moving averages. A settlement above that area would target a test of the 2.50 level.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.