by market analysts Stephen Platt and Mike McElroy

Price Overview

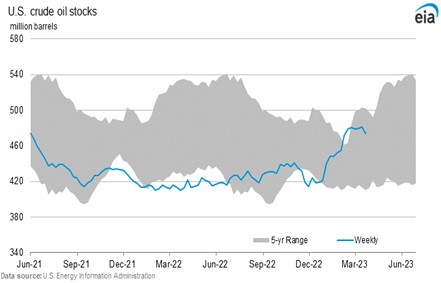

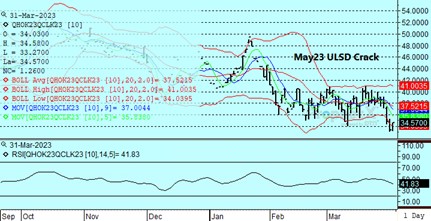

The petroleum complex continues to react to the suspension of exports of more than 400 tb/d of supply from Iraq’s Kurdistan region along with the larger than expected decline in US crude inventories. The DOE report along with the export disruption to exports from Kurdistan has provided better overall support to the crude while the crack spread margins have been undermined with the 2 Oil Crack showing the greatest losses while the gasoline crack has pulled back dramatically as well.

Higher refinery utilization rates and lagging demand has provided better support to the crude while products have lagged the movement upward despite today’s recovery. The 2 oil has lagged significantly as weather, a prospective slowdown in spending and adequate inventory levels in Asia and Europe appears to be limiting interest. The RBOB crack, which had reached a new high of 39.47 into the DOE report has also sold off reaching a low of 35.25 today basis May but did show a recovery to around 36.50. We are still looking for robust travel to underpin gasoline demand this summer but with expansion in refining capacity further gains, above the 40.00 level might be labored.

In crude, we still see that with the scale of liquidation evident recently by hedge funds and speculative interests, the market is on a much more favorable footing for responding to fundamental influences that might impact the underlying supply demand balance. It still appears that Russian oil is still readily available and that it has crowded out some other crudes due to the level of discounting. Nevertheless, more favorable demand prospects in China along with stability in production levels due to recent price pullbacks will likely lead to a more balanced market in the second half that should limit declines much below the 70.00 level for prompt crude and provide the basis for a renewed test of the 80.00 level basis prompt WTI. The OPEC+ Ministerial Price Committee which meets on Monday, is not expected to make any changes to their output targets.

Natural Gas

Nat gas attracted renewed buying interest and short covering. An improvement in demand forecasts for next week along with rising amounts of gas for LNG export plants is providing support. The recovery in Freeport shipments to 2 bcf /d from 1.5 bcf/d on Friday should help absorb some of the excess inventories which remain near 20 percent above normal. The EIA report yesterday, showed a smaller than expected withdrawal of 47 bcf at 1,853 bcf compared to year ago levels of 1,411. The high inventory levels suggests any movement to the upside will be labored particularly as we move into spring when demand is typically weak. Overall, we continue to look for 2.10-2.15 basis May as support while overhead resistance is likely to be stiff near the 20 day moving average at 2.46.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.