by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded in a volatile fashion, with values declining as much as 2 dollars in early trade before recovering strongly to finish higher by 1.52 per barrel in April WTI. The weakness was traced to a Wall Street Journal report outlining political tension between the UAE and Saudi Arabia over disagreements regarding negotiations with Yemen, OPEC oil policy, and competition for foreign investment and markets for oil. The report suggested UAE officials were having internal discussions about leaving OPEC due to their displeasure with having to produce at levels well below their sustainable capacity, and desire to produce more given their expansion in refining capacity and the export limits on the Soviets. The UAE denied the reports, which lead to short covering as the market switched focus back to signs that the Chinese economy is beginning a recovery and might record growth as high as 5 percent in 2023. Contributing to the strength were reports of a fire on a pipeline in Nigeria owned by Shell, raising concerns that it may impede their recent recovery in production.

Although the move higher in interest rates remains a source of concern, the direction of the US economy that it reflects could be a harbinger of more constructive demand prospects overall.

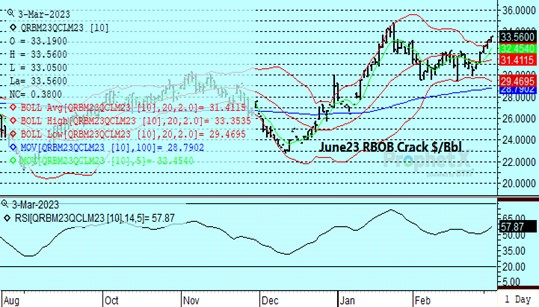

This week’s DOE report might mark a turning point in inventory trends, as disappearance levels improve on expanding net export levels and a seasonal pickup in gasoline demand which has been reflected by strength in the crack. Look for a move toward a deficit position later this year, providing the basis for values to advance into resistance near the 81.00-82.00 range and potentially 101 on prompt crude in the intermediate term.

Natural Gas

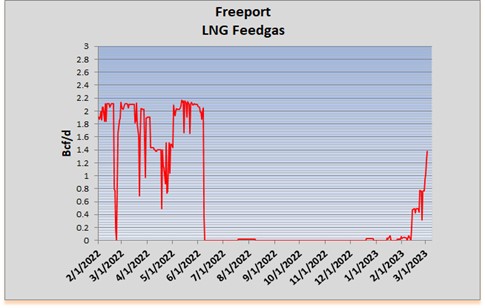

The 3-dollar level was violated today, as the April reached an intraday high at 3.027 before settling 24.4 cents higher at 3.009. Sentiment is building toward the idea that the supply/demand balance is moving toward equilibrium. Freeport LNG continues to take in more gas, reaching 1.4 bcf today, which is more than 60 percent of capacity, while overall LNG flows were indicated at a record 13.8 bcf. Weather revisions were supportive, with colder temperatures projected in the 15-day outlooks, albeit back-end loaded. In the background and mostly unmentioned were increased pipeline flows to Mexico, which have recently inched up to 5.8 bcf/d. The move above 3 dollars now targets 3.36 which would achieve a 38 percent retracement of the winter break. In order to extend to those levels, the cold temperatures currently forecast will need to be maintained in the coming days. Initial support should surface near 2.70 and beyond there in the 2.53-2.50 area.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.