Price Overview

The petroleum complex failed to follow-through on early strength as a substantial build in product inventories and weak disappearance in today’s DOE report led to long liquidation. The early buying appeared to be linked to ideas that Iranian sanctions will not be lifted quickly following reports that key issues still need to be resolved, along with the uncertainty associated with the Iranian Presidential election on June 18th. In addition, the belief that global oil demand will trend significantly higher as increases in mobility in Europe, the US and even India added support.

Weakness developed in response to the DOE report along with some nervousness over Chinese demand. Government efforts to restrict crude imports into the bloated refining sector have led to expectations that they could fall by as much as 3 percent, or around 280 tb/d.

The weekly storage figures showed crude inventories fell a larger than expected 5.2 mb, while gasoline and distillate inventories rose sharply by 7 and 4.4 mb, respectively. Total inventories of crude and products rose by 15.5 mb. Despite an increase in net crude imports to 3.7 mb/d from 3.1 last week, a sharp increase in refinery utilization to 91.3 percent from 88.7 helped reduce crude inventories. Weak disappearance accounted for the large build in product stocks. Total product disappearance was reported at 17.7 mb/d compared to 19.1 mb/d in the prior week, with gasoline off by .7 tb/d to 8.5 and distillate off .4 mb/d to 3.4 mb. We suspect that a strong recovery should develop in coming weeks as commuter traffic and economic activity pick up.

The OPEC monthly report is set for release tomorrow and should provide additional insights into demand trends. In the absence of a move by OPEC to increase production along with a lack of movement toward lifting export sanctions on Iran, we suspect that the market will hold support near the 66.00 level and move toward the 2018 highs near 76.90 in prompt WTI crude as stocks continue to be drawn down into the summer and OPEC moves cautiously toward a more expansive production policy.

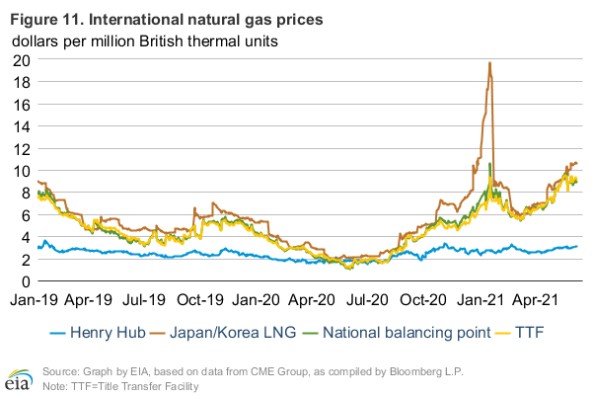

Natural Gas

The test of 3.20 came sooner than expected as the July reached a peak of 3.198 early in the session yesterday. The quick spike was fueled by another round of warmer forecast revisions as the 15 and 45 day outlooks indicated a jump in CDD’s. The market traded calmly today with volume contracting and prices ending near unchanged levels. Maintenance issues continue to constrain LNG processing, with flows under 9 bcf over the last 4 days. The decrease has been offset by strong Mexican exports, and trade seems to be willing to look past the current slowdown as overseas LNG prices remain elevated and exports look to be profitable for the forseeable future. In their Short Term Energy Outlook released yesterday, the EIA estimated that LNG flows would remain above 9 bcf/d for the remainder of the year, while they expect production to grow gradually to average just over 93 bcf/d over the same period. With resistance near 3.12 already taken out, the market seems intent on pushing higher with another test of 3.20 likely in the near future. If temperatures continue to trend warmer, the double top at 3.40 on the weekly chart would be the next target. The 3.05 level now looks like initial support on pullbacks.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.