Price Overview

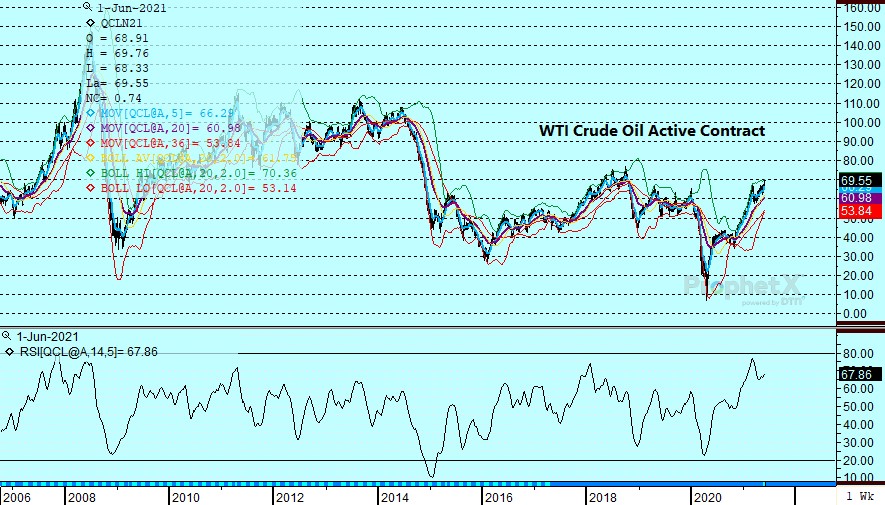

The petroleum complex closed out the week with strong gains on the appearance that OPEC has maintained production discipline in the face of higher prices. Russia’s compliance in May was reported near 100 percent, which helped ease concerns following reports that their April compliance had fallen to 91 percent. Ideas that demand will come back strongly were supported by a larger than expected pickup in US refinery utilization in yesterday’s DOE report to 88.7 percent, an increase of 1.7 from the prior week but still below the 91.8 percent seen 2 years ago. The long-awaited recovery from the pandemic has offered support as travel by air and land picks up dramatically. With the vaccine rollout moving along successfully in key consuming areas such as the US and Europe, the improvement in demand has raised concern over a deficit later this year.

Ideas that demand might be stronger than expected would be bolstered if the Asian pandemic begins to come under control. With the supply/demand balance getting tighter on the better than anticipated production discipline, any unexpected deviation in demand or supply will have an inordinate impact on values. As summer progresses a clearer picture of demand trends should emerge as the high prices and widening deficit are reflected in global production responses and demand fallout. Given this weeks’ breakout to the upside, the market appears within striking distance of the high made in October of 2018 at 76.90 on the active contract following the alleged attack by Houthi rebels on Saudi production facilities.

Natural Gas

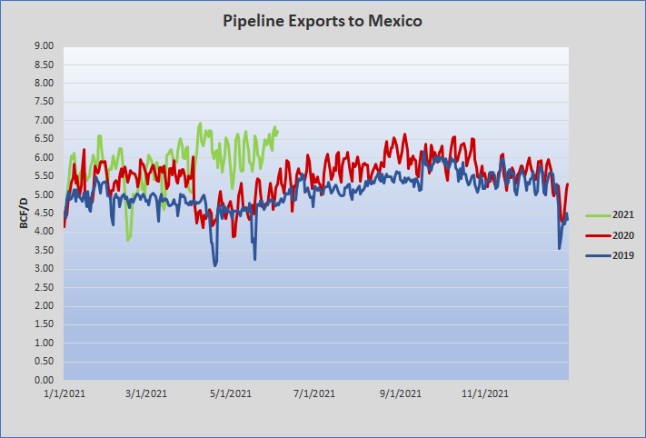

The market gave back some early week gains over the last two sessions as CDD expectations eased from the substantial upward revisions seen on Tuesday. Yesterday’s storage report indicated a 98 bcf injection, slightly above estimates, which lead to additonal downside pressure but ultimately had a muted effect as there may have been some relief from speculation that the number would exceed 100. Prices bounced back today as late session strength pushed the July to a settlement at 3.097, a gain of over 5 cents. The market appeared to find support on various forward looking factors, including expectations for above normal temperatures in Europe over the next two to three weeks, which could further solidify the belief that LNG exports will remain strong. The US also has above normal temperatures expected in the 7-10 day period, while production seems to have settled in to the 91 bcf/d area and has not shown any signs of perking up. The most impressive factor remains Mexican exports, which have quietly reached all time highs. The move through 3.05 basis July could indicate a transition to a new trading range as we enter the summer injection season. The mid-May highs near 3.20 look like the next upside target with the 3.00 area the first level of support.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.