Price Overview

Crude prices traded in a firm fashion with reports of a prospective sale of 6 billion of crude from the Strategic Petroleum reserve or over 80 million barrels as part of the infrastructure deal lending caution on the long side early. The total sale would potentially represent about 13 percent of the SPR. Nevertheless, the prospect for an infrastructure agreement and the associated positive impact on economic activity appeared to mute the reaction. In addition the market continues to attract support from the decline in crude inventories particularly in the US as demand globally continues to expand especially in the US , Europe and even China as vaccine roll-outs progress worldwide. . Product markets lagged as recent high refinery rates maintained inventory levels and kept pressure on the cracks.

For next week the focus might shift to OPEC+ and the Ministerial meeting which takes place on July 1, Some easing of supply curbs is anticipated at the end of August. Reports suggest as much as 500 tb/d will become available in September as the expansion in demand continues to absorb supplies. Prospective deficits of as much as 2 mb/d are expected in the fourth quarter which continues to underpin values. Ideas that the Iranian nuclear talks continue to encounter obstacles related to outstanding issues following a statement by Secretary Blinken that serious differences remain; suggests that the US and its allies appear to want broader controls on armaments and regional policy than the Iranians are prepared to accept.

The need for OPEC to expand output as non-OPEC producers appear unable to quickly ramp up output suggests a tightening situation, which will need to be addressed in coming months. So far the discipline OPEC has shown continues to be a surprise given the prevailing price levels. In the absence of any action from the cartel to increase production substantially along with slow progress toward lifting export sanctions on Iran, we believe the market will continue to move toward the 2018 highs near 76.90 in prompt WTI crude as stocks continue to be drawn down throughout the summer.

Natural Gas

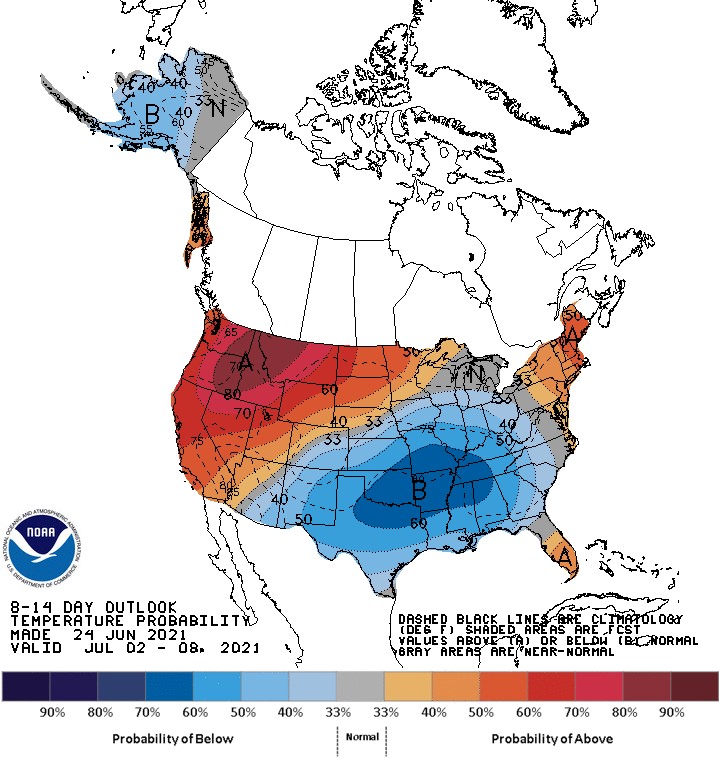

Nat Gas continued the surge higher reaching new highs for the move of 3.527 basis August. The smaller than expected build of 55 bcf/d compared to expectations of 66 bcf/d reported yesterday by the EIA along with strong export levels of LNG and record pipeline exports to Mexico continues to attract good buying interest. Despite the strong buying noted this week, the market will be watching the 8-14 temperature forecast in the near term. Prospects for below normal temps throughout the South might provide a pause for the price strength in the near term as demand pulls back particularly in Texas and heat into early July fails to materialize. Nevertheless, the tightening supply demand balance should provide support on setbacks toward the 3.30-3.35 level basis August given the developing tightness in inventories and strength to international LNG markets.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.