Price Overview

The petroleum complex traded mixed as crude saw modest gains while products were under pressure. The expansion in refinery utilization along with the larger than expected recent builds in product stocks lead to good selling of the cracks. In the background supporting crude values was the IEA Monthly report released today. Key elements of the report include:

- Global oil demand is set to return to pre-pandemic levels by the end of 2022, rising by 5.4 mb/d in 2021 and a further 3.1 mb/d next year. The OECD accounts for 1.3 mb/d of 2022 growth while non-OECD countries should contribute 1.8 mb/d. Jet kerosine demand will see the largest increase at 1.5 mb/d followed by gasoline at 660 tb/d y-o-y and gasoil/diesel at 520 tb/d y-o-y.

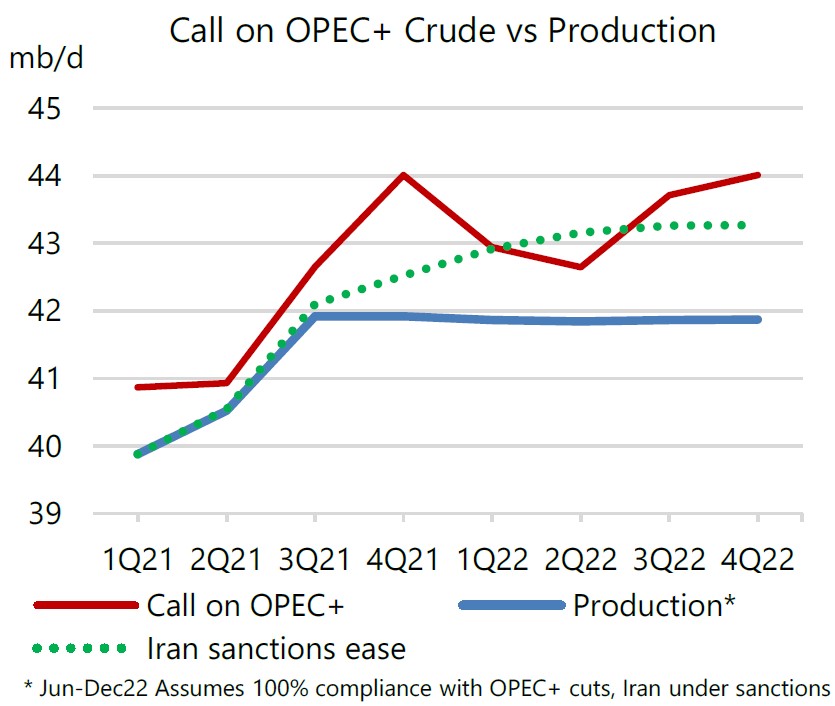

- World oil supply is expected to grow at a faster rate in 2022, with the US driving gains of 1.6 mb/d from non-OPEC+. Such a scenario would allow OPEC+ to boost crude production by 1.4 mb/d above the July-2021 to March 2022 target rate compared to current policy aimed at increasing production by 800 tb/d.

- Global refinery throughput in 2021 is expected to recover half of the 7.4 mb/d fall in 2020, lagging demand growth for refined products as surplus inventories are drawn down. In 2022, refining activity is forecast to increase by 2.4 mb/d. 3.8 mb/d of new capacity coming online over 2021-22 will be partially offset by 2.3 mb/d of announced closures or conversions to bio-refineries.

- OECD industry stocks held relatively steady in April, at 2 926 mb, but fell 1.6 mb below the pre-Covid 2015-19 average for the first time in more than a year. May preliminary data for the US, Europe and Japan show that industry stocks rose by a combined 17.2 mb. Crude oil held in short-term floating storage declined by 6.8 mb to 99.4 mb in May, its lowest since February 2020.

The need for OPEC to expand production as non-OPEC producers appear unable to quickly ramp up output suggests a tightening situation which will need to be addressed in coming months. How quick their response is given their large available sustainable capacity will be a key price consideration. In the absence of any move by OPEC to increase production and a lack of movement toward lifting export sanctions on Iran, we suspect the market will hold support in the 66.00-68.00 level and move toward the 2018 highs near 76.90 in prompt WTI crude as stocks continue to be drawn down into the summer and OPEC moves cautiously toward a more expansive production policy.

Natural Gas

Prices shot up on last night’s reopen after it was announced that recent limitations on some TETCO pipelines moving gas from the Northeast to the South Central region would be extended, possibly through the third quarter. The ultimate fallout from the restrained flows remains to be seen, but the news came at a time of low volume, and when the 3.20 level was violated prices quickly shot up to the 3.26 area as stop orders were elected. Despite the appearance that the initial reaction was overdone, prices maintained their upside momentum during the day session, with the July trading as high as 3.33 before settling at 3.296. Weather again supported prices as the 15 day and 45 day forecasts added CDD’s, with June shaping up to be one of the warmest in the last 30 years. Additional excitement was added by signs that LNG flows may be starting to bounce, as the last two days saw a return to the 9.5 bcf/d area. With Mexican exports surpassing 7 bcf/d, the market is not lacking supportive influences. The rapid rise and overbought technical condition could set up the market for a jolt lower, especially if weather reports cool off over the weekend. Look for 3.20 to support any recoil of prices, with the upside momentum ultimately returning to test double top at 3.40 on the weekly chart.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.