Price Overview

The petroleum complex continued to trade in a firm fashion with good buying interest continuing to be noted on ideas the impact from the Omicron variant will be mild and temporary and that demand will continue recovering in line with growth to the global economy. The appearance that OPEC+ will struggle to meet their production target which was confirmed to have increased by 400 tbdd at their meeting this past Tuesday also remained in the background along with the prospect demand will exceed current expectations given the prospect that shortages of Nat Gas will force the substitution of petroleum derivatives to ease the shortfall. The prospect that this might account for as much as 500 tb/d in additional demand for crude appears to be restraining fresh selling interest despite forecasts that production will overtake demand during the first quarter helping to start the process for the rebuilding of inventories.

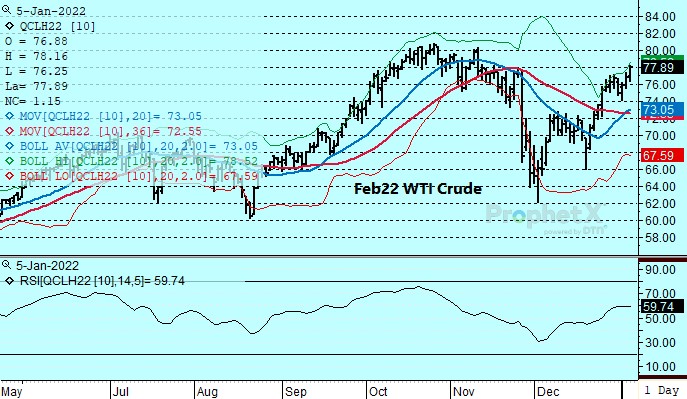

At this juncture, we think some caution on the long side is warranted and weaker valuations might be in evidence. The DOE report did not show any marked tightening in petroleum inventory levels despite the draw in commercial crude inventories of 2.1 mb. Instead both gasoline and distillate inventories rose sharply with gasoline rising by 10.1 mb and distillate rising by 4.4 mb. The build was sharply above expectations with total inventories of products and crude excluding the SPR rising by 10.2 mb. The unexpected large build appeared to not only reflect end of the year inventory adjustments but also the impact of Omicron on travel between Christmas and New Year. Total product supplied totaled 19.7 mb compared to 22.2 mb a week ago and 17.1 mb a year ago. Net imports of crude and products were 947 tb. Crude production is also holding at 11.8 mb compared to 11 mb a year ago while refinery utilization was indicated at 89.8 percent marginally above last week and compared to 80.7 percent a year ago. due to the large increase in infection rates from Omicron.

The appearance that OPEC+ is maintaining the output increase in February at 400 tb/d should offer resistance as prompt Brent reaches above the 80.00 level to as high as 81.50 today might prompt concerns of SPR releases globally and demand concerns. In addition strength to the dollar and higher interest also might pose a headwind to values. In Feb Crude, support exists near the 73-74 level basis Feb Crude.

Natural Gas

Prices rallied on reports freezing temps in some producing areas had shut in some production and adversely affected gas processing equipment. In addition slow gas deliveries to Europe by Russia continue to support international prices near record high levels as low inventories continue to . With forecasts suggesting temperatures will remain below normal for the remainder of this month, further gains are likely which should carry values back up toward the 4.00-4.05 level and possibly as high as 4.25 basis Feb. With stocks still above normal in the US but well below normal in Europe and Asia expansion in US export capacity is likely to take place over time providing support to the back months. A further draw down in US storage is likely in tomorrow’s EIA report with forecasts for a draw of 158 bcf compared to a five year average draw of 108 bcf and 127 bcf a year ago.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.