Price Overview

The petroleum complex came under concerted selling pressure on concerns over rising COVID infections and associated lock-downs in China. Additional pressure was attributed to the unexpected build in crude oil inventories reported by the API yesterday of 2.6 mb, compared to expectations for a modest decline. Given the strength to the Chinese economy in the last half of 2020, signs that a renewed economic retrenchment is underway appeared to shade demand expectations to the downside. Reports that Iranian exports had increased despite the US sanctions also provided a bearish backdrop to values given the expectations of an easing in tension under the Biden Administration. Although it is not expected to happen quickly, the possibility of additional supplies competing with the OPEC curbs remains a source of caution on the upside, particularly in the back months. Forecasts that demand might decline marginally in the first quarter of 2021 due to the pickup in infection rates remain in the background as a key consideration, along with questions as to whether OPEC cuts are enough to balance the market.

The delayed DOE report showed crude oil inventories rose 4.4 mb compared to expectations for a decline of -.3 mb. Gasoline stocks fell. .3 mb while distillate stocks built by .5. Total stocks including products fell .7 mb and stand at 1,971.7 mb compared to 1972.4 a year ago, while crude stocks are at 1,124.6 mb compared to 1,063.1 a year ago. Refinery utilization increased to 82.6 percent compared to 82.0 last week.

Although the petroleum complex has taken some consolation from the stimulus package proposed by the Biden Administration, the potential impact is contingent on its implementation, ultimate level of stimulus, and timing. In the background jobs data appears to be weakening once again. China and India have been the bright spots, and how they navigate through the resurgence in infections and associated lock downs will be watched closely. On the supply side, reports that Saudi Arabia will cut as much as 1 mb/d in production during February and March is supportive. Uncertainty over compliance levels continues to be a concern due to the reluctance of Russia to cut output further, the reported pickup in Iranian export levels, and the failure of Iraq to live up to promises to compensate for previous overproduction. The rising incidence of infections in China and ensuing lock-downs have potential to undermine values, while dollar weakness and expansionary fiscal policy has tended to provide support.

Natural Gas

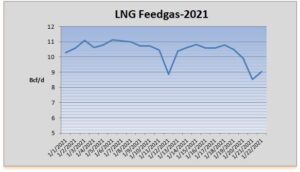

Prices continued to erode into the end of the week as the March contract lost 4 cents today to finish at 2.456, which was the lowest settlement of the year. Weather forecasts continued to decrease HDD expectations throughout the week, with warmer than normal levels now expected into early February. Near term issues effecting LNG flows to Sabine Pass due to fog and maintenance added downside pressure, with an uptick in flows today possibly signaling that the trend has turned. The weekly storage report, released today due to the inaguration, showed a stock drawdown of 187 bcf verses expectations near 174. Although it didn’t result in much of a bounce, the release did offer some underlying support and seemed to halt the downside leakage. Trade now waits to see what surprises the weekend forecast revisions will bring, as recent history has seen large price moves on Sunday night. With a low today at 2.425, that area likely offers solid support as LNG flows improve and coal to gas switching emerges.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.