Price Overview

The petroleum complex maintained a firm tone on expectations of a quick return to normalcy following the large spike in Covid infections traced to Omicron. Additional support continues to be derived from a shortfall in OPEC production levels and uncertainty over whether future output increases, as specified in the OPEC+ agreement, will be attained.

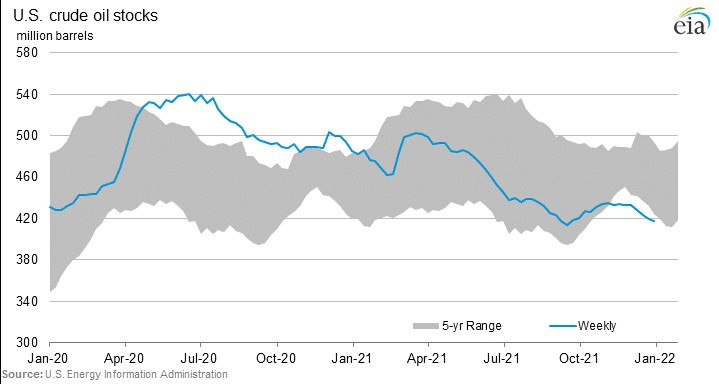

Given the concerns over low inventory levels, the potential for further deficits appears to be attracting buying interest. The DOE report failed to dispel these fears despite a sizable build in both gasoline and distillate stocks. The report showed crude inventories falling more than expected at 4.6 mb. Commercial crude inventories now stand at 413.3 mb compared to 482.2 last year and are at their lowest level since October of 2018 when prompt values reached a high near 77.00. Prices are now at levels not seen since 2014, prior to the emergence of shale as a primary production source. The report also showed gasoline inventories rising by 8 mb and distillate inventories increasing by 2.5. Due to other oils (a residual calculation) falling 8.9 mb, total petroleum stocks declined by 4.5 mb. Disappearance was indicated at 20.8 mb with other oils having a sizable increase and accounting for the strong showing.

The market appears to be concerned as to whether OPEC can make up for slow growth in production due to supply chain disruptions and the focus on shifting from carbon-based sources of energy to renewables, which is limiting investment in longer term production. For now, this appears to be the overriding consideration given their shortfalls compared to targeted output rates. Current prices will certainly entice additional output, and this already appears to be developing in North America given forecasts for an expansion in production.

Natural Gas

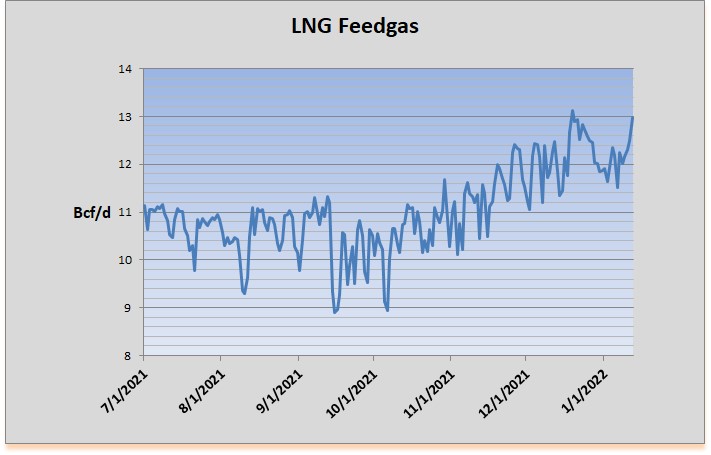

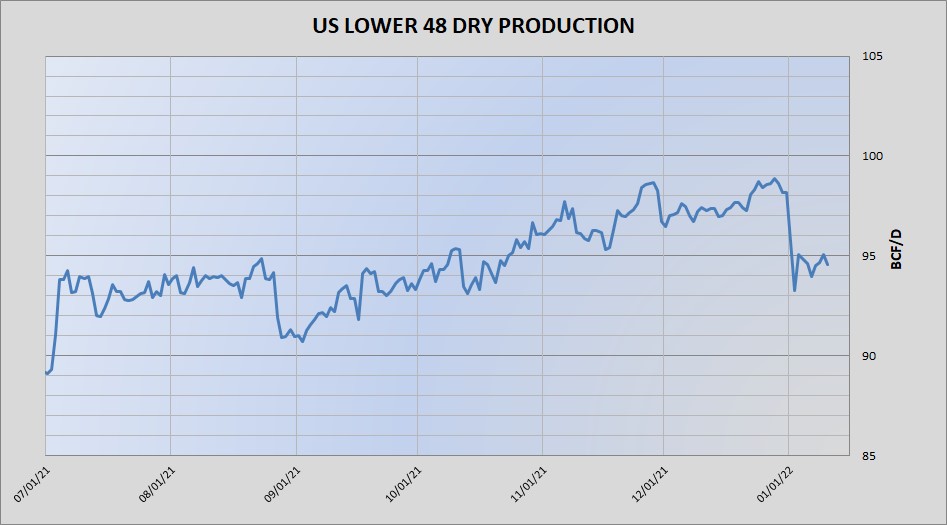

The rally continued today as the February contract gained over 60 cents to end the day at 4.857 and near the session highs, while the March gained 36 cents to 4.327. The strength continues to be coming from the arrival of cold temperatures, as January is shaping up to be one of the coldest in nearly a decade. The 15-day forecasts are also pointing to the potential for extremely cold temperatures to end the month, with longer term outlooks hinting at a carryover into February. Production has yet to show any bounce from its recent retrenchment, and with LNG flows reaching up to 13 bcf today the market did not lack for supportive influences. Despite the positive fundamental picture, the move was exaggerated as short positions were put in a squeeze and began to head for the doors. Tomorrow’s storage report is expected to show a draw of 173 bcf compared to the 5-year average decrease of 155, while early estimates for next week are nearing 200. With the strong close the market has reached the 100-day moving average near 4.82, and follow-through likely targets the 5.00 area. Initial support should emerge in the 4.65-4.70 range.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.