Price Overview

The petroleum complex continued to pull back from last week’s gains as concern over the impact of unrest in Kazakhstan moderated following reports that production is returning to normal. The recovery in Libyan output following maintenance also weighed on values. Nevertheless, concern over shortfalls in OPEC’s December production verses targets remained in the background and helped moderate declines.

The market appears primed for a moderate retracement of the recent upside trend toward 75.00 basis February. The situation in Kazakhstan has stabilized due to the government’s hardline approach to protesters and the involvement of Russia by sending paratroopers at the request of the government to quell the uprising. The potential exists that these events will soften the Russian stance toward Ukraine given a possible reluctance to further inflame tensions around their borders. Continued signs that OPEC’s African members are experiencing challenges hitting increased output targets provided background support.

Forecasts still suggest surpluses in the first quarter, albeit smaller than had been expected. Although Omicron concerns have eased, the worst might be ahead in terms of infection rates, which could reign in mobility and demand for gasoline and jet kero in the next few weeks and lead to further stock builds that could weigh on values. OPEC Middle East producers have maintained targeted production levels and appear to have capacity for further expansion. Whether they will attempt to make up for shortfalls by African producers remains to be seen, along with whether SPR releases take place as planned. A wild card remains the Iranian Nuclear negotiations where reports on progress have been lacking.

The DOE report on Wednesday is expected to show crude inventories falling by 2 mb, distillates rising by 1.5 and gasoline increasing by 2.5. Refinery runs are expected down .4 to 89.4 percent.

Natural Gas

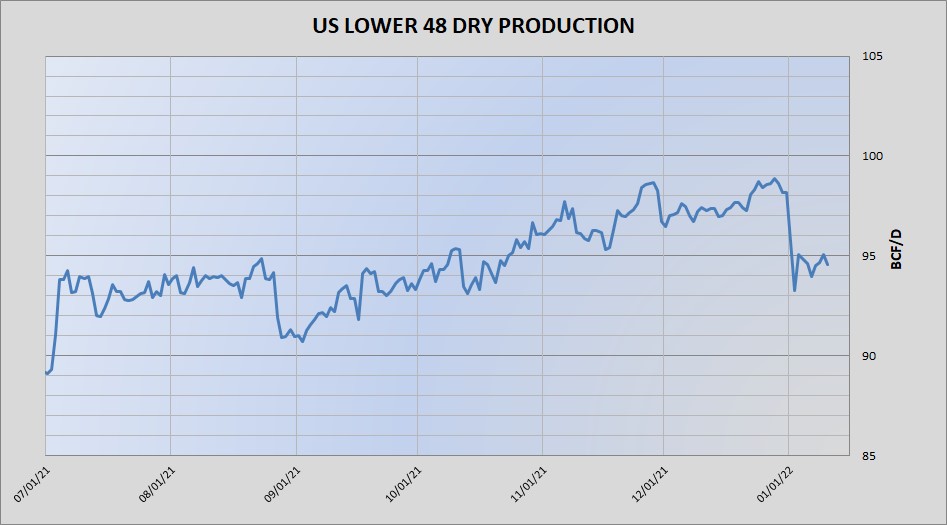

Prices gapped higher coming out of the weekend with the February contract reaching 4.213 intraday before ending the session 16 cents higher at 4.079. Weather revisions on Sunday were bullish compared to Friday’s reports, with demand expectations increasing by as much as 36 bcf in the 15-day outlook. Today’s forecast revisions were slightly less bullish as prices pulled back in the middle of the session before recovering again into the close. The onset of cold temperatures this month has coincided with a substantial pullback in production levels, which has helped to underpin the rally. With current expectations pointing to colder temperatures and above average storage draws for the remainder of the month, the market may have put in its lows for January. The settlement above 4.00 points to potential follow-through, with the 38 and 50 percent retracement levels of the late November break coming in at 4.25 and 4.45 respectively. With LNG flows back above 12 bcf/d the 3.80 level remains as substantial support on any negative weather volatility.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.