by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded mixed with modest selling in nearby WTI despite a larger than expected draw in US inventories reported by the DOE. The back months continue to attract support reflecting ideas that demand will be supported as the year progresses provided global growth remains on an upward trajectory despite lingering economic uncertainty in Europe, China, and India.

Indirect talks between the US and Iraq to revive a nuclear deal remain in the background as a negative influence given the presence of large Iranian afloat stocks and potential for production to expand quickly if sanctions are lifted. The US turning a blind eye to rising exports from Iran and Venezuela into China has recently been apparent, suggesting a greater emphasis is being placed on quelling inflationary fears than strict enforcement of sanctions against those countries. Such an attitude might be moderating the US stance in some areas with respect to the Iranian negotiations. An additional source of selling interest has been US production expectations. EIA forecasts suggesting US crude output will rise again this year to 11.97 mb/d, an increase of 770 tb/d, suggests higher prices have had an impact, with further increases expected in 2023. The EIA also suggested the potential for the world supply/demand situation to move toward surplus into the last half of the year.

The failure to respond to what was perceived as a positive DOE report was surprising, but might suggest some of the bullish influences in the market have been priced in. The report showed crude inventories falling 4.8 mb, gasoline inventories down by 1.6 and distillate lower by .9 mb. Total petroleum stocks declined by 8.1 mb with fuel ethanol inventories showing a drop of 1.1 mb. Crude imports fell to 6.4 mb from 7.1 in the prior week, with net imports of crude reaching 3.3 mb compared to 4.7 last week. Product supplied remained robust at 21.9 mb with gasoline surging, likely ahead of wintry conditions, while distillate disappearance showed a decline of 400 tb to 4.3 mb/d. Capacity utilization surged to 88.2 percent compared to 86.7 last week.

We suspect that Friday’s high of 93.17 basis March is an intermediate top and that selling pressure toward yesterday’s lows near the 88.50 and possibly toward 85.00 could be seen. Demand fallout from current high prices and possible reductions in market share of OPEC members in the event of a US-Iranian nuclear deal along with the expansion of non-OPEC production should encourage the cartel’s main producers to do all they can to expand output, helping ease inventory tightness. Additional guidance on the supply/demand situation will be provided by OPEC with their monthly report on Thursday, followed by the IEA Monthly report on Friday.

Natural Gas

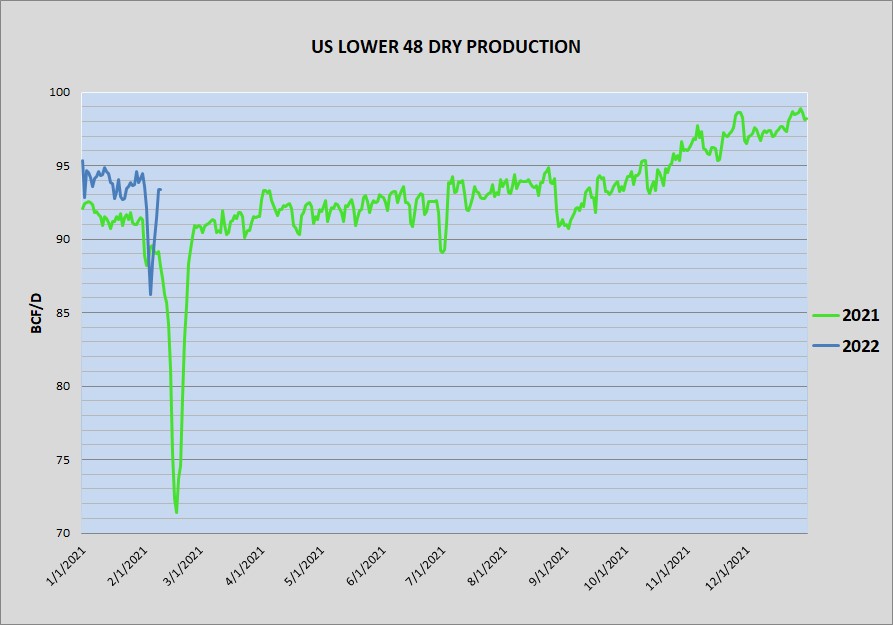

The market could not find any support today and lost another 24 cents to settle at 4.009 basis March. The quick production recovery was the focus as lower 48 output reached back above 93 bcf/d, basically reaching pre-storm levels as fear of an extended drop similar to last year have disappeared. Forecasts remained unsupportive as well, with minor downward revisions in HDD expectations in the 15 day outlooks. LNG flows have dropped nearly 1 bcf recently and added to the negative bias. Tomorrow’s storage report is expected to show a 222 bcf stock drawdown, which would be well above the 5 year average of 150. A high side surprise may be needed to slow the downside pressure and hold the 4.00 level now that it has been tested. A failure at 4.00 would find minor support in the 3.90-92 range but nothing supstantial would stand in the way of a test to the mid-January lows in the 3.63 area. A swing back to a colder weather trend would encounter little resistance until reaching Monday’s gap above 4.487.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.