by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded in a volatile fashion with crude values dipping toward the 75.00 level early in the session, where support developed and values rallied to as high as 78.00 on the bullishly construed jobs report. The recovery could not be sustained as values quickly fell to new lows, as higher interest rates and strength to the dollar raised fears of an economic slowdown. Further price declines appear limited by the potential for a Chinese economic recovery and with SPR purchases likely on further weakness. One caution on the long side has been the increase in large spec positions which have potential to exacerbate the losses.

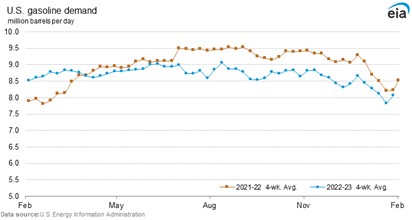

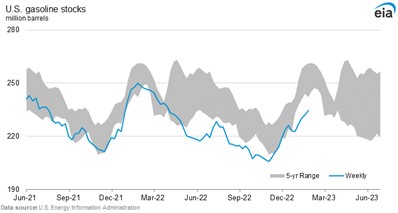

Expect better support to emerge on further weakness to the RBOB crack. Potential increases in travel this summer should support the gasoline crack near the $28-$29 per barrel level basis June. In addition, a recovery in the Chinese economy will aid travel patterns as well. In gasoline, US stocks remain low and under the five year range. A pickup in disappearance levels into the summer should tighten supplies, particularly if the price cap by the G-7 and import embargo of products by the EU disrupt Russian refining rates and availability of products.

Natural Gas

The steady creep lower continued for the natural gas, as the March contract lost 4.6 cents today to settle at 2.41. there doesn’t seem to be anything that can excite this market at the moment. Freeport’s request to federal regulators yesterday to begin loading LNG offered little upside, and production losses from freeze-offs caused by the current extreme low temperatures in multiple producing regions has also done little to foster buying interest. Yesterday’s storage report showing a 151 bcf draw was well above estimates at 142, but again could not excite buying as overall storage now stands nearly 7 percent above the 5-year average. With January in the books as one of the warmest on record and February showing no signs of flipping the narrative, this market will likely continue to struggle at least until Freeport has actually started to export LNG, which looks to be at least two to four weeks away. With another new low for the move achieved today, 2 dollars remains the downside target. A recovery will not find substantial resistance until the 2.70 area, and beyond there near 3 dollars.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.