by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded on both sides of unchanged but closed on a firm note as conflicting fundamental influences affected sentiment. Prospects for lower Russian exports have been offset by rising US inventory levels along with reports that afloat inventories of Russian crude have built up dramatically over the past few months. Their announced production cut along with reports that export levels of Urals crude will be cut in March helped offset the impact of a larger than expected inventory build in the US and rising inventory levels in Singapore and ARA. While rising interest rates reflect a tighter Fed policy, the appearance that the US economy remains on solid footing with the exception of the housing sector continues to be limiting downside pressures on ideas that usage rates will increase as mobility in China and the US improves.

The DOE report yesterday showed a conflicting tone. Crude inventories rose by a larger than expected 7.6 mb, with Cushing stocks higher by .7 mb to 40.4 mb. Gasoline stocks fell by 1.6 mb while distillate increased by 2.7. Total stocks of crude and products rose by 3.3 mb as propane and other oils continued to fall. Refinery utilization dropped to 85.9 percent compared to 86.5 last week. Disappearance levels were at 20.2 mb compared to 21.5 last year, with gasoline disappearance rising to 8.9 mb verses 8.3 last year, while distillate slipped to 3.8 mb compared to 4.2 a year ago.

Choppy price action is likely near term as dollar strength and higher interest rates produce headwinds, but look for support to persist in the 74-75 range. Disappearance levels should show improvement in the intermediate term, particularly in gasoline. The US economy remains buoyant, which should provide a basis for a recovery in demand, while the Chinese economy appears to be gaining steam. Although higher interest rates pose a threat to the recovery, we see the market moving into a deficit situation on a global level later this year. How large those deficits are will help determine how much prices can recover, with the 80-82 range key near term resistance.

Natural Gas

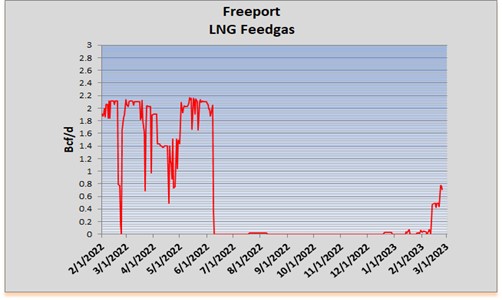

The market managed to maintain the upside momentum from mid-week, following up yesterday’s 13 cent gain with a close 11.6 cents higher today at 2.548 basis April. With March expiring today and Freeport steadily taking in more gas, the market is attempting to build a bottom on hopes that the supply/demand imbalance is swinging toward improvement. Yesterday’s storage report showed a 71 bcf drawdown, higher than estimates but still well below the 5-year average of 177. Wednesday’s test below 2 dollars on the February contract seems to have initiated a wave of short covering. The market finally managed to settle above the 9-day moving average at 2.445 basis April in a possible signal of some near term follow-through. The next level of resistance should surface at the mid-February highs near 2.70, with 3 dollars the next target if additional short-covering is flushed out, but weather will have to trend colder to squeeze much more out of the upside beyond there. The 2.44 area should offer minor support on a pullback, with the recent lows near 2.11 the next target if sentiment again turns negative.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.