by Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continued to trade in an erratic fashion. Reports of progress in the Iranian negotiations and the scheduling of further talks next week with the Russian ambassador attracted early selling interest. Values found support near 87.50 basis April on pre-weekend short covering and scattered buying linked to ongoing concerns over Russian intentions and whether a visit by the Ukrainian President to Munich this weekend for security talks with Western powers will be able to take place given the political risks.

The Iranian negotiations appear to be getting more focus with sources suggesting that OPEC+ will work toward integrating Iran into its current agreement. The prospect that a successful outcome to the talks might lead to an additional 1.3 mb of supply coming to market has potential to ease the current tightness in inventory levels. The fears that inflation is accelerating has likely been a strong motivating force on the US and other Western powers.

An Iranian deal is reportedly taking shape that lays out phases of mutual steps to bring both sides into compliance, with the lifting of oil sanctions likely one of the last steps. An accord is still being drafted with the broad objective of returning to the original plan to lift sanctions in exchange for restrictions on its nuclear activities. The draft sets out a sequence of steps including Iran suspending uranium enrichment activities above 5 percent purity, unfreezing 7 billion in Iranian funds from South Korea, and the release of Western prisoners held in Iran. Some are suggesting implementation might take 1-3 months after an agreement is signed.

From the Ukraine, Iranian negotiations, and uncertain economic outlook, a multitude of forces are coming into play that will have a significant longer-term impact on the market. It is hard to digest the myriad of outcomes and implications which suggests a cautious stance is warranted along with strategies that mitigate risk.

Natural Gas

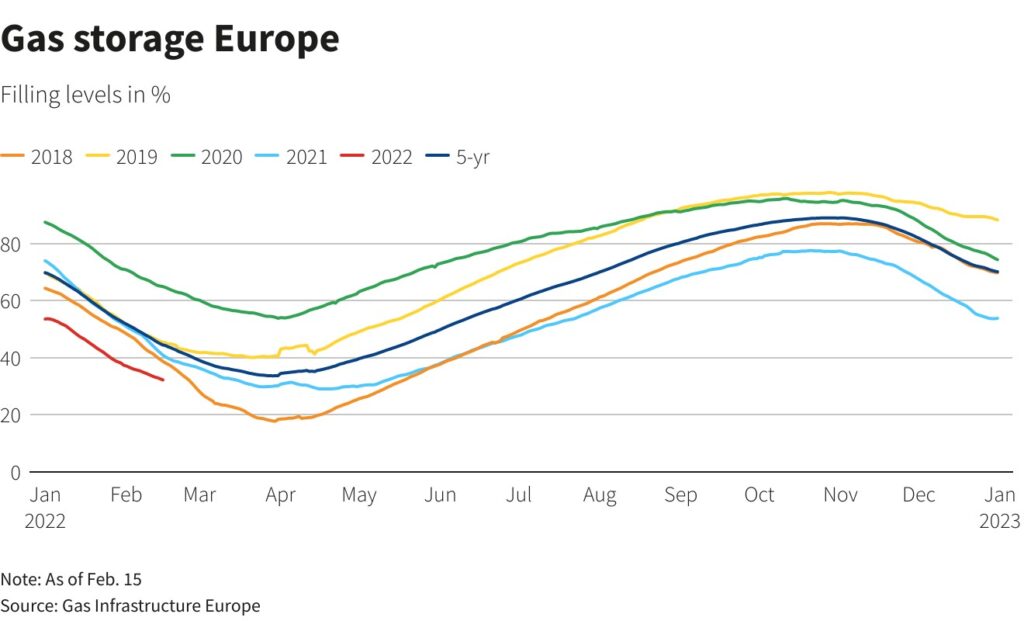

Prices have consolidated over the last two sessions after strong gains were registered through mid-week. The March contract ended lower by 5 1/2 cents at 4.431 while the active April lost 5 cents to 4.377 after being down 15 cents yesterday. The weather continues to be the main driver of prices, as some easing of the colder late February trend brought out selling interest that gained momentum after the storage report. The 190 bcf draw from stocks was below estimates and seemed to deflate trade as bull hopes for another 200 plus decrease were dashed. Next weeks number is likely to break the string of above average draws as record wind generation ate into natural gas demand. This weeks rally completed a 68 percent retracement of the early February break. A settlement above 4.60 basis April is likely necessary to trigger follow-through on the upside. The 4.30 level should offer support, and beyond that the 4.00 area if forecasts continue to moderate. As we move into the shoulder season, some attention will turn to the summer stock rebuild. Despite European stocks surviving due to a mild winter, they are still at a 5 year low as all indications point to a need for LNG imports to refill the tanks. The coming weeks will begin to focus on US end-of-season stocks and whether they are at a comfortable level considering the potential for a continuation of strong export demand and the trend of summer temperatures.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.