Price Overview

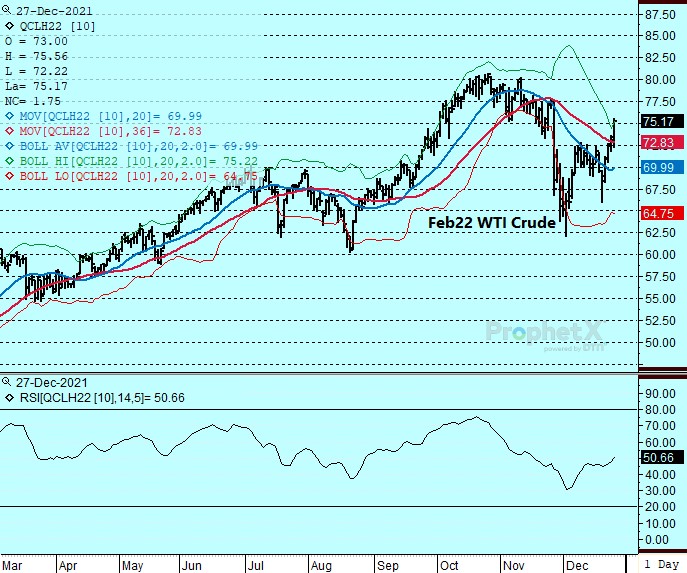

Early selling interest developed in the petroleum complex in response to increasing cases of Covid from the Omicron variant along with the start of negotiations between Western powers and Iran over the lifting of sanctions and development of nuclear weapons. The weakness could not be sustained, and values subsequently rallied sharply on strength to industrial commodities and natural gas encouraged buying and touched off short covering. Some of the support appeared to be traced to ideas China would provide stimulus in the new year to what appears to be a stagnating economy. Prospects that this will boost oil demand beyond what is currently expected helped propel most industrial commodities that are dependent on Chinese demand sharply higher as fears over low stock levels in crude and products underpinning values. The Iranian Nuclear negotiations also appear to be stalling with some participants suggesting that they are rapidly reaching the end of the road given the lack of progress and the refusal of the Iranians to meet face to face with the US.

Reduced natural gas flows into Europe remain a source of concern as Russia continues to blame the delays at approving the Nord Stream 2 pipeline as limiting the availability of additional supplies and keeping values at record highs. The strength to gas prices is likely helping crude and products on the possibility that demand will strengthen as a result. The uncertainty is coming at a time when shortages of key inputs foster uncertainty over supply and capital investment as we move into 2022, helping underpin a shift upward in inflationary expectations. With inventories of crude and products remaining low, concerns over a tight supply environment remain in the background. How that might change appears contingent not only on the OPEC+ production policy but also on the trajectory of growth in the world economy.

The response of OPEC+ at their meeting on January 4th will be watched closely. For now, with values in the cartel’s favored range between 60-80 dollars per barrel, we are doubtful any significant changes in policy will be made. An additional consideration will be China and the level of monetary stimulus they provide their economy in the new year.

The DOE report Wednesday is expected to show crude inventories down 3.3 mb, distillates off by .1 and gasoline unchanged. Refinery runs are expected up by .1 to 89.7 percent.

Natural Gas

As expected the storage report released last Thursday was extremely bearish, showing a small 55 bcf withdrawal and swinging total storage above the 5 year average. The market reacted accordingly, registering sharp losses of over 20 cents ahead of the long holiday weekend. Prices rebounded today as the February contract gained back all of those losses to end the session higher by 31 cents at 3.942. Hope continues to hang on cold temperatures expected in early January that could bring the first string of below normal readings of the winter. The strength developed in spite of further warming in the near term forecasts, with an expected pullback in wind generation over the next few days offered support. The late rally appeared to touch off short covering, with stop orders elected above 3.90. We still see the 4.00 area as solid resistance until the early January cold begins to materialize. Support near 3.50 likely holds up with so much winter left.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.