Price Overview

The market attracted good follow-through after yesterday’s strong recovery as concerns over the impact of the Omicron variant on economic activity appeared to wane and outside markets in the industrial sector and international equities strengthened. Shortages of key inputs continue to foster uncertainty over supply prospects and capital investment as we move into 2022, helping underpin a shift upward in inflationary pressures and expectations. With inventories of crude and products remaining low, concerns over a tight supply environment remain in the background. How that might change appears contingent not only on the OPEC+ production policy but also on the trajectory of growth in the world economy and concurrently global oil demand. Of particular interest will be the degree of substitution of petroleum derivatives for natural gas in Europe where shortages remain due to lower flows from Russia. Whether the reduction in supply is linked to the tension on the Ukrainian border is being monitored and provides an additional variable to how tight supplies might become.

The response of OPEC+ at their meeting on January 4th will be watched closely. For now, with values in what is seen as the cartel’s favored range between 60-80 dollars per barrel, we are doubtful any significant changes in policy will be made. An additional consideration will be China and the level of monetary stimulus they provide their economy in the new year. Weakness in the property sector has been significant and some support looks likely. In crude, import and stock levels have fallen following additions to inventories during 2020. Indications that no strategic purchases are likely in China might temper import levels at a time when demand could expand on the injection of additional stimulus to support the economy.

The DOE report continued to show low inventories of both crude and products. Commercial crude stocks fell 4.7 mb despite a draw in the SPR of 2.5 mb. The SPR crude stocks are at their lowest since November 2002. Stocks at Cushing rose by 1.5 mb to 33.7. Gasoline inventories rose by 5.5 mb while distillates were up .4. Total petroleum stocks excluding the SPR fell 7 mb. Refinery utilization was 89.6 percent compared to 89.8 last week. Total exports of crude and products were 313 tb. For the year we have averaged a pace of 531 tb in crude and product exports. Total product supplied has averaged a daily rate of 20.1 mb against 18.3 mb/d in 2020.

We see support at the 69.50-70.00 area basis February with 73.50-73.75 resistance into the OPEC+ ministerial meeting on January 4th.

Natural Gas

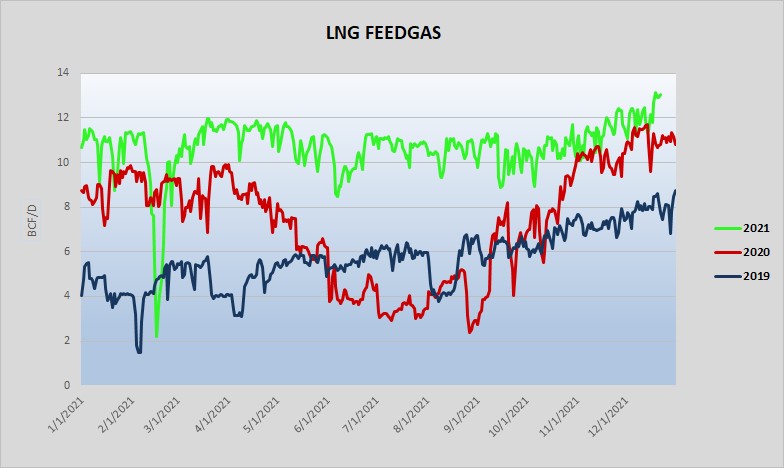

The natural gas market managed to settle higher for the third straight day as the February contract ended the session at 3.86 for a gain of 8 1/2 cents. The below normal temperatures predicted in the first week of January held up in the most recent forecast revisions, and the market seems willing to overlook near term warming in favor of the potential for the first true cold spell of the season. Prices are also being underpinned by the situation overseas, where European values have spiked to all time highs as Russian gas flows through the Yamal pipeline actually reversed over the last few days as the Kremlin continues to play games while feigning innocence as they attempt to pressure the approval of Nord Stream 2. The result of record high overseas prices continues to be reflected in US LNG flows which are hovering around 13 bcf/d, near capacity with no slowdown in sight. The market still has to digest what is expected to be a very negative storage number this week (estimated 56 bcf withdrawal verses 5-year at 153), but with all the risk premium extracted with the break from late November, most of winter still ahead of us, and overseas prices at huge premiums, the 3.50 level looks like solid support. The 4.00 area likely holds up to any further strength until a clearer picture of the early January cooling comes into view.

The authors of this piece do not currently maintain positions in the commodities mentioned within this report.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.