by market analysts Stephen Platt and Mike McElroy

Price Overview

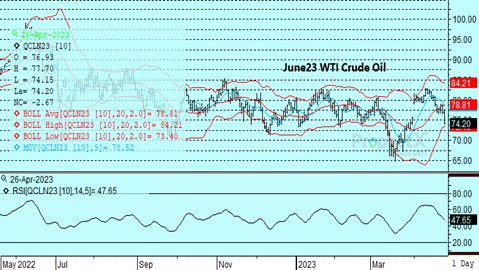

The crude oil failed to hold against recent lows at 76.72 basis June, and then filled the gap left following the OPEC cut announcement at the beginning of April. The weakness reflected growing fear over demand prospects ahead of the FOMC meeting on May 2nd and 3rd and US debt limit negotiations. In the background were recurring reports that Russian output might not have fallen despite government announcements that production would be cut by 500 tb/d in March. Russian export levels remain robust, especially to Asia where India and China have not adopted sanctions, which weighed on prices. Crack margins have been weak, suggesting refinery throughput might be throttled back as well.

Although buying interest was noted in reaction to the DOE report and on expectations that the OPEC cuts that go into effect in May will tighten supplies as we move into the summer, the rally attempt failed and renewed liquidation developed as interest rates moved higher and forced attention back on US and European economic prospects.

The DOE report showed commercial crude inventories falling by 5.1 mb, with sales of 1 mb reported from the SPR. Cushing stocks rose .3 to stand at 33.1 mb. Refinery utilization was at 91.3 percent. Gasoline stocks fell by 2.4 mb while distillate inventories declined by .6. Total commercial stocks of crude and products fell .4. Net exports of crude and products continued to be restrained at 1.7 mb as secondary inventories are worked off.

The market continues to be weighed down by economic concerns and Russian availability. Today’s breakdown below 77.00 in June WTI should lead to a test of the 73.00-73.50 level where we look for better support to develop. Although fears persist that the US Federal Reserve will pursue a tighter monetary policy for longer than had previously been expected, the potential for a pause following a likely 25 basis point hike in May could allow the economy to recover as additional stimulus provided by the Infrastructure and Inflation Reduction Act later this year helps maintain economic growth. There is potential for a recovery in the Chinese and Indian economies that could help expand global consumption levels. The overall stock situation has stabilized, and participants will be looking for signs of a shortfall between supply and demand, with forecasts for a deficit developing into the latter half of the year. The strength to both the Chinese economy and the depth of recession in the US will be watched closely to see if it leads to a deficit trend in inventories.

Natural Gas

The frailty of recent price strength was evident today as the market dropped 13.2 cents to settle at 2.305 basis June. The expiration of the May contract played into the volatility as it went off the board with a loss of 19 cents at 2.117. A slowing of LNG flows added fuel to the downside, as today marked the third straight session with loadings in the 13.5 bcf area as Sabine Pass enters a seasonal maintenance period. The decrease comes as production has yet to show any signs of a pullback, with output steady this week near 101 bcf/d. Tomorrow’s storage report is expected to show a build of 75 bcf compared to the 5-year average injection of 43, further swelling the supply overhang. With intermediate support taken out today, the market could be slowed near 4.20 but the next likely target is the contract lows near 2.14. A bounce will run into resistance in the 2.37-2.41 range.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.