by market analysts Stephen Platt and Mike McElroy

Price Overview

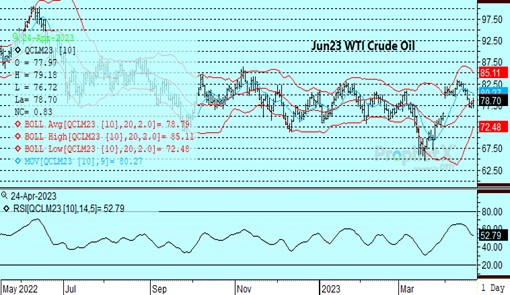

The petroleum complex continued to improve upon last week’s late recovery, holding Friday’s low at 76.72 basis June crude. Support was traced to reports that the restart of crude exports from Kurdistan totaling 450 tb/d will be delayed. Although an agreement has been reached and signed, details surrounding the deal still need to be worked out between the Iraq’s crude marketing company and the Kurdistan Regional Government. Some have suggested a restart of exports might be as much as two to three weeks away. Additional support was linked to the US debt limit negotiations. The republican proposal for lifting the debt ceiling is tied to repealing new energy tax credits that were included in the Inflation Reduction Act.

The retest of Friday’s low and ability to hold support in the 77-78 range today has given further evidence that an intermediate low is in. Although fears persist that the US Federal Reserve will pursue a tighter monetary policy for longer than had previously been expected, the potential for a pause following a likely 25 basis point hike in May could allow the economy to recover as additional stimulus provided by the Infrastructure and Inflation Reduction Act maintains economic growth. We still see the chance for a recovery in the Chinese and Indian economies and stronger than expected growth in Europe helping expand global consumption levels at a time when availability, particularly from Russia to Asia, has exceeded expectations.

Recent weakness has helped relieve the overbought condition that transpired following the surprise OPEC cut announcement. The overall stock situation appears to have stabilized as well and participants will be looking for signs of a shortfall between supply and demand, with forecasts for a deficit developing into the latter half of the year. The strength to both the Chinese and Euro-zone economies will be watched closely to see if it more than offsets the slowing expected in the US.

In the absence of a more definitive Fed policy, the market is likely to consolidate between key support at the 77.00 area and recent highs near 83.00. Underlying support should build into summer with a stronger than expected US economy leading to a move toward the 90-91 range as a pick-up in gasoline and jet kero demand tightens supply availability.

Natural Gas

The market traded with a firm bias coming out of the weekend, ending the session with a gain of 6.3 cents at 2.471. Compared to Friday’s runs, the 15-day forecasts gained 15-20 bcf in demand expectations, and coupled with weekend LNG loadings reaching yet another record above 14.7 bcf, it was enough to spur a test of the 2.50 area at midday. Overall volatility has remained subdued with tight ranges seen as we wrap up the shoulder season, but there is potential for a spike in action as we approach the May contract expiration on Wednesday. The positive close keeps the near term bias to the upside, with the 2.50-2.54 range offering decent resistance and a move through that area signaling a test to 2.60, which would mark a 38 percent retracement of the March-April break. Initial support rests near 2.38, and failure there likely fills the mid-April gap level down at 2.316.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.