by market analysts Stephen Platt and Mike McElroy

Price Overview

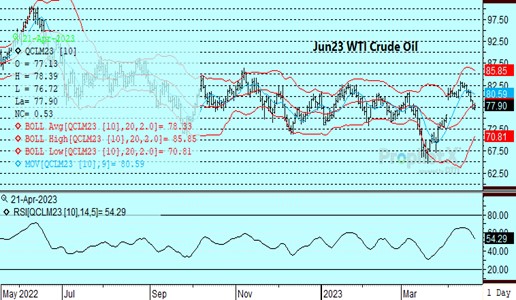

The petroleum complex recovered modestly from recent losses that had carried June crude to a low of 76.72 overnight. The back months in crude continue to gain on the nearby, reflecting better demand prospects.

Support in the 77.00-78.00 range basis June has held up thus far with today’s settlement at 77.80. Concern that the Federal Reserve will pursue a tighter monetary policy for longer than previously expected and good availability from Russia to Asia continues to provide a counterbalance to indications that a Chinese recovery is underway following strong first quarter GDP reported at 4.5 percent. Aiding the constructive sentiment in China was the continued recovery in the Euro-zone economy following the release of the Purchasing Manager’s Index that showed an increase to an 11-month high of 54.4 in April compared to 53.7 in March. Reports of a call between Putin and Saudi Prince Muhammed bin Salman also caused some nervousness over the potential for additional steps to support the market.

Recent weakness has helped relieve the overbought condition that had transpired following the surprise OPEC cut. The overall stock situation appears to have stabilized as well, and participants will be looking for signs of a shortfall between supply and demand with forecasts for a deficit developing into the latter half of the year. The strength to the Chinese and Euro-zone economies will be watched closely to see if it offsets the economic slowing expected in the US.

Weakness in US leading indicators suggests a possible recessionary trend, so how long the US Federal Reserve sticks to the restrictive monetary policy will be a key factor for the possible supply shortfall and whether the Fed navigates a hard or soft landing in the US economy.

In the absence of a more definitive Fed policy, the market is likely to consolidate between 77.00 and recent highs near 83.00. Underlying support should build into summer, with a stronger than expected US economy leading to a move toward the 90-91 area as a pick-up in gasoline and jet kero demand tightens supply availability.

Natural Gas

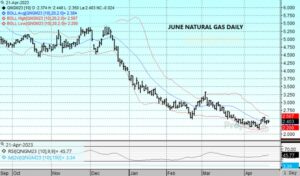

The last two sessions produced tight ranges, as the June contract settled with minimal losses at 2.408 today and within 10 cents of where it started the week. Yesterday’s storage report showed an injection of 75 bcf, exceeding estimates and well above the 5-year average build of 41. Total stocks now stand at 1,905 bcf, which is more than 20 percent above the 5-year average. Aside from the colder than normal temperatures maintained in the 2 week forecasts, the shoulder season has thus far offered little excitement. Trade will soon turn its attention to assessing the potential weather trends this summer, along with the ability of LNG exports to maintain their rapid pace with European stocks well above average. The market managed to settle above the 9 and 20-day moving averages, which maintains a slightly positive tone near term, with 2.50 initial resistance on the upside. Support now rests near 2.36 with a violation of that level pointing to a test of the lows near 2.14.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.