by market analysts Stephen Platt and Mike McElroy

Price Overview

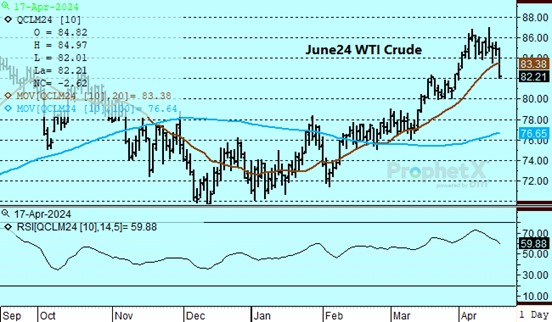

Crude oil traded down through the 20-day moving average at 83.47 basis June, touching off stop-loss liquidation to settle at 82.15 for a loss of 2.68. Nervousness surrounding events in the Middle East persisted as the market assessed whether or not retaliatory action against Iran will take place following what was an ineffective strike this past weekend by Iran against Israel. Major allies who have committed themselves to the defense of Israel are suggesting a measured response in order to avoid any further escalation of tensions, which has helped moderate buying interest and encourage disappointed selling by speculators. Downside pressure was also traced to the DOE report which showed a larger than expected build in crude inventories, and demand concerns after Powell’s statement yesterday indicating hesitancy to lower interest rates given consumer price trends. The Fed’s policy direction will keep upside pressure on the dollar which in turn will limit overseas demand for crude and petroleum products due to the increasing price in foreign currency terms.

The DOE report showed crude oil inventories building by 2.7 mb while gasoline stocks and distillate stocks fell by 1.2 and 2.8 mb, respectively. Total stocks of crude and products rose by 10.0 mb due to sharp increases in propane and other oils. Refinery utilization was at 88.1 percent, off .2 from the prior week. Disappearance levels were 19.22 mb/d, unchanged from last week and compared to 19.3 last year. Total net exports of crude and products recovered to 2.8 mb/d from the 2.0 last week.

The weakness today has taken values decisively through support near the 84.00 level. Demand concerns are at the top of many traders’ minds given the potential weakness in demand from China and India due to dollar strength. Lower prices may provide the basis for demand recovery that could provide support near the 80.00 level basis June WTI. Middle East supply disruptions have been moderated due to the alliance that aided Israel during the Iranian attack. This group is comprised of the US, Jordan, the UAE, and Saudi Arabia, and suggests that there is potential for a more forceful alliance in the region once the war in Gaza reaches a conclusion. This would be a strong counterbalance to Iran and their proxies. The risk to oil supply remains in the background given that Iran produces over three million barrels and has strategic control over the Straits of Hormuz, where 20 percent of the world’s oil moves through.

Natural Gas

The recent steady decline in prices was paused yesterday afternoon after reports of an explosion and fire on a TC Energy pipeline in Alberta, Canada. The markets knee-jerk reaction saw prices jump 15 cents in a matter of minutes after the news hit on concern that Canadian imports into the US could be slowed. After the smoke cleared, prices retrenched to give back most of the gains late yesterday as the situation appeared under control with minimal fallout. Trade refocused concern on poor LNG flows as the situation at Freeport drags on with little guidance from the company, along with poor weather demand as we continue to stack month onto month of above normal temperatures. Today saw an inside day on the charts with the May ending 2 cents lower at 1.712 on light volume. Slowing production has garnered some buying interest at these low prices as the market attempts to make a bottom ahead of the summer injection season. The 1.691 level marks the low settlement, and a close below that level could propel prices to a test of the 1.50 area. The 1.78 to 1.80 range will offer stiff resistance on a bounce.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.