by market analysts Stephen Platt and Mike McElroy

Price Overview

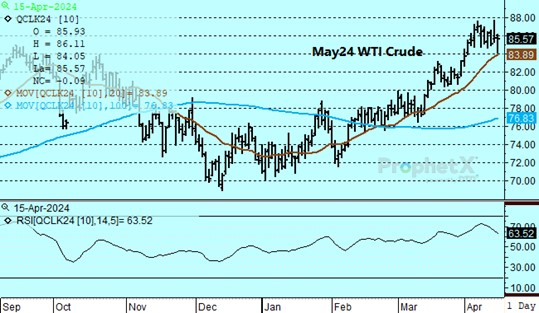

Crude oil recovered from early pressure that pushed values down to 84.10 basis May to settle at 85.66 for a loss of 25 cents. The weekend attack by Iran on Israel was less damaging than anticipated and helped ease concerns and reduce risk premium that had been injected prior to the weekend. The attack, which involved over three hundred missiles and drones, was the first on Israel by another country in over three decades.

Iran has indicated that its retaliation is over and now market participants are waiting to see whether Israel will act in response to the strike. Given the recent pressure on Israel to moderate their offensive in Gaza and the associated fear over the effect on oil supplies and prices, we are at an impasse. The risk to oil remains in the background given that Iran produces over three million barrels and has strategic control over the Straits of Hormuz, where 20 percent of the world’s oil moves through. Iran does not appear to want the war with Israel to expand given the substantial impact it would have on its economy if supplies were disrupted in the Straits.

Support near the 84.00 level basis May has held up. Look for the 88-90 range to be tested on the uncertainty associated with geopolitical tension in the Middle East and the likelihood that Russia will reduce exports to levels consistent with the OPEC+ agreement. A potential headwind to further upside will be the potential for dollar strength and higher prices to temper demand, particularly from China and India, and to also encourage efforts to expand output by non-OPEC producers, limiting stock drawdowns later this year. Under this scenario it remains questionable whether OPEC+ can maintain production discipline given declining market share and budget needs.

The DOE report is forecast to show crude stocks gaining .4 mb, distillate up .1 and gasoline down by 1.0 mb. Refinery utilization is expected to gain .6 to 88.9 percent.

Natural Gas

The week kicked off with a negative tone as the May contract probed out a new low before closing with a loss of 7.9 cents at 1.691. Multiple issues contributed to the follow-through weakness. LNG flows contracted over the weekend to the 11.5 bcf/d area as Freeport appeared to have all three trains down and maintenance at other facilities decreased flows further. Weather forecasts warmed, and adding to that poor demand trend was an expected spike in wind generation near term that could decrease gas burns by as much as 3 bcf/d. The market managed to settle just above the previous contract low from late March, but the poor close leaves the downtrend firmly entrenched. To find an area of potential support we have to look back at the March and April contracts, which both tested the 1.50 area prior to going off the board. A recovery in values will find little resistance until the 9 and 20-day moving averages currently near 1.80.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.