Price Overview

The petroleum complex traded sharply higher and through resistance levels on favorable forecasts from OPEC and the IEA suggesting that demand was likely to grow sharply in the second half of 2021. The upward revisions were in stark contrast to reports over the past year where demand had been steadily scaled back. The changes reflected optimism that the COVID-19 vaccine rollout is progressing enough to support increasing demand. Ideas that stimulus programs, particularly in the US, are reflationary and will support global growth at 6 percent in 2021 and 4.4 percent in 2022 was also indicated. China and the US continue to be the main drivers. Additional support was provided by the DOE report that indicated a larger than expected decline in crude stocks, helping alleviate concern over high reserve levels in the US as refinery utilization, which reached 85 percent, continues to ramp up.

The DOE report showed crude stocks declined by a larger than expected 5.9 mb. Gasoline showed a modest increase of .3 mb while distillate stocks declined by 2.1 mb. Total stocks including products fell by 9.1 mb. Product supplied totaled 20.3 mb, with the 4-week average 20 percent above year ago levels.

Demand recovery will likely continue to be a source of uncertainty, and the US and China will likely preoccupy the focus. Expectations for summer mobility to pick up appreciably this year is likely to underpin values for now. Nevertheless, some caution will be apparent given the sustainable capacity of OPEC and desire to ramp up output in line with demand expectations.

Natural Gas

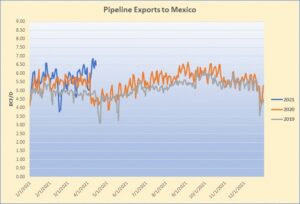

Prices looked poised to close higher for the sixth straight day as the May contract put in an intraday top at 2.666 early this morning, but lost steam into the second half of the session to close near unchanged levels at 2.618. Support continued to be provided by the current stretch of cool temperatures across a large portion of the US, with Total Degree Days running above average in the 2 week forecasts. Additional support emanated from the recent upswing in exports to Mexico, which could play an important role this summer if the trend can continue. Coupling it with the potential for LNG exports to remain strong in the coming months could lead to tightness this summer if we see an above normal temperature pattern develop. The early strenght was tamped down by the potential large storage build to be released tomorrow, with expectations pointing to a 67 bcf build verses the 5 year average at 26. With the 2.60 resistance taken out yesterday the next upside target would be the 200 day moving average near 2.69. Any continuation of the late session weakness likley finds support near 2.55.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.