by market analysts Stephen Platt and Mike McElroy

Price Overview

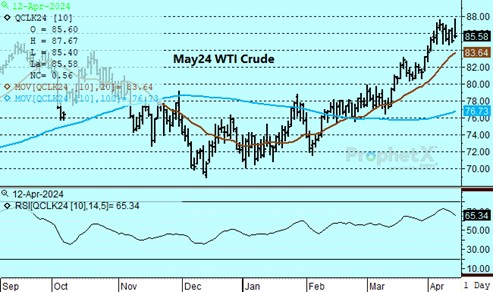

The petroleum complex traded firm, with the May crude settling 64 cents higher at 85.66 but well off its highs. Talk of a retaliatory strike against Israel by Iran as early as this weekend raised the chance of supply disruptions in the Middle East and heightened associated risk premium in oil markets. Neither the OPEC or IEA Monthly Report had significant impact on sentiment, with the IEA cutting its forecast for oil demand growth moderately to 1.2 mb/d in 2024 and OPEC maintaining forecasts for growth of 2.2 mb/d.

The IEA indicated:

- World demand growth continued to lose momentum with 1st quarter indicated at 1.6 mb/d, 120 tb/d below the previous forecast due to weak deliveries to the OECD. Due to better vehicle efficiencies and the increases in EV vehicles, a further slowdown in oil demand growth in 2024 and 2025 is expected.

- In 2024 global supply growth is expected to rise by 770 tb/d to 102.9 mb/d, with non-OPEC growth expanding by 1.6 mb/d. Assuming voluntary cuts remain in place, OPEC+ supply should decline by 820 tb/d.

- Global observed inventories rose by 43.3 mb in February with oil on water at its highest in over 15 months. Conversely inland stocks remain tight and fell to their lowest levels since 2016. OECD commercial stocks fell 7.6 mb in February and were 65.1 mb below the five-year average.

The IEA suggested that robust production from outside of OPEC coupled with a projected slowdown in demand growth will lower the call on OPEC+ crude by 300 tb/d, and effective spare capacity could top 6 mb/d, the largest supply buffer ever.

Expect setbacks to be limited, with support near the 84.00 level basis May. The 88-90 range will likely be tested on the uncertainty associated with geopolitical tension in the Middle East and the likelihood that Russia will reduce exports to levels consistent with the OPEC+ agreement. A headwind on the upside will be the potential for dollar strength and higher prices to temper demand, particularly from China and India. Higher prices will also encourage expanded efforts to increase output by non-OPEC producers, limiting stock drawdowns later this year. Under this scenario it would be difficult for OPEC+ to maintain production discipline given declining market share and budget needs.

Natural Gas

Selling returned to the market after yesterday’s storage report, as the 24 bcf build was well above expectations for an 8 bcf increase. Gains from the first half of the week were quickly erased as the May contract lost 12.1 cents to settle at 1.764. Today’s action was subdued as the market ended with a small gain at 1.77. Late revisions also erased signs of a recovery in volume at Freeport, with total LNG flows contracting toward the 12 bcf/d area to end the week, which added to the negative tone. The current trading range between 1.70 and 1.90 is well entrenched and will likely be maintained until we work through shoulder season and start to get hints of summer weather trends. The low end of the range should be maintained due to slowing production and extremely low prices historically, while rallies will be reined in by the ample storage situation in the US and Europe.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.