by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex continued to build on yesterday’s gains, with crude settling higher by 1.73 at 83.26. Gasoline and ULSD have lagged the move, with the May 2 oil crack trading near recent lows of 30.00 per barrel and the gasoline crack finding resistance at its recent highs near 38.00. Economic prospects for the US and China remain in focus. The slight cooling in the US CPI helped raise hope that the Fed might be approaching the end of its tightening cycle, with most participants expecting only a 25-basis point hike in fed funds followed by a pause and a potential soft landing for the US economy. A slowdown in consumer inflation in China to levels not seen since September of 2021 sparked concern that their recovery may not be as pronounced as previously expected. Providing support in the background are the OPEC production cuts. The EIA forecast that OPEC output will decline by 500 tb/d in 2023 and then rise by 1 mb/d in 2024 following the expiration of the OPEC+ output agreement. Non-OPEC production is expected to rise by 1.9 mb/d in 2023 and 1 mb/d in 2024.

The DOE report released today showed commercial crude inventories rising by .6 mb/d, with gasoline and distillate stocks falling .3 and .6 mb respectively. Total stocks of crude and products rose 6.8 mb, offsetting the large decline last week of 11.0. Refinery utilization fell to 89.6 percent from 90.3 last week. Total disappearance levels fell to 19.1 mb compared to 20.6, with gasoline off .4 to 8.9 mb while distillate fell by .5 to 3.8 mb. A sharp decline in net export levels to .2 mb likely precipitated the weaker disappearance levels and can be seen as a bearish aspect of the report in the short term.

The DOE report was disappointing, and the market will now be watching the OPEC and IEA Monthly reports on Thursday and Friday. The recent rally could begin to see resistance in the 84-85 area. Pullbacks will likely be limited as a tighter inventory situation becomes apparent into the summer, with upside potential toward 91.00 basis prompt crude. Good support is likely at the 77.00 level basis prompt crude.

Natural Gas

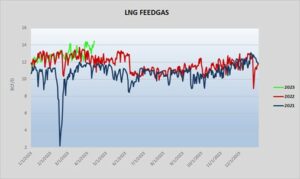

After a feeble attempt to follow through to the upside early in the session, prices worked lower the rest of the day to settle with a loss of 9.3 cents at 2.093. A lack of any excitement from the weather models kept the reality of current ample storage and lackluster demand front and center. Tomorrow’s storage report should mark the end of the withdrawal season, with an injection of 28 bcf expected, which is in line with the 5-year average. LNG exports remain the underlying supportive factor, as recent record flows above 14 bcf/d offer hope that the supply glut can be whittled away if we can get some above average cooling demand as we start the summer. Today’s weakness brings the 2-dollar support level right back into view, with a violation of that area leading to a test toward 1.80. The 20-day moving average, currently at 2.254, is a key resistance level that will need to be taken out to have any hope of flushing out fund short covering.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.