Price Overview

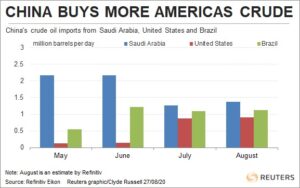

Prices traded on both sides of unchanged with crude attracting scattered selling on indications that Hurricane Laura had inflicted no damage to upstream or downstream petroleum facilities. With many refineries who had shut up to 2.9 mb/d and US crude producers shutting up to 83 percent of Gulf of Mexico production along with the closure of the LOOP pipeline facility, re openings without major damage was welcome and led to an easing in the risk premium. Downside movement was generally limited and values steadied as the session wore on as the dollar weakened, equity markets regained strength and precious metal values surged. Some support was also traced to reports that China crude oil throughput had increased sharply as imports from both Brazil and the US showed strong increases and demand for diesel and gasoline reportedly moves back to pre-pandemic levels. China appears to have ramped up import levels from the US to show compliance with the trade deal. It would not be surprising to see these import levels continue to ramp up as we move through September to the detriment of the Saudis and possibly Brazil. The higher import levels of crude and higher refinery output comes at a difficult time given the weak margin for products in Asia. Refining margins for gas-oil in these markets have dropped to $ 4.15, the lowest levels since early June, and heightened exports of products are expected to continue as refiners attempt to exhaust their oil export quotas. With the arb window shut due to unprofitable margins for shipments from Asia into Europe, the build in these inventories could limit demand in the future as excess stocks are worked off. Demand prospects will be key and any sign mobility is weakening due to the pandemic in these areas would likely undercut values as we move into the 4th quarter given the pickup in available supplies from the Saudis and on reports that North Sea output will be increasing by about 100 tb/d in October.

For next week, some caution might be apparent ahead of the DOE report and its indications regarding the level of disruption from Hurricanes Laura and Marcos and their impact on crude and product stocks. For the most part these effects have been priced in but caution ahead the report’s release might be apparent.

Natural Gas

As expected volatility was high as Hurricane Laura progressed and passed over offshore and onshore energy infrastructure. The October broke out to the upside yesterday when uncertainty regarding storm fallout was at its highest, with follow through early today pushing levels to an intraday high at 2.743. Prices pulled back as the session wore on and indications began to surface that many key sights had avoided major damage. October ended the day 5.3 cents lower at 2.657. LNG feedgas demand remained low with Sabine Pass and Cameron still shuttered, although it did uptick to 2.8 bcf today from 2.4 yesterday. Production was indicated lower by .7 bcf early this morning, but with revisions likely ends up steady in the 86 bcf/d area. How quickly these facilities can get back up and running will be a key factor in determining how much prices retrench in the wake of the hurricane. Weather forecasts came back into focus as CDD expectations were revised substantially downward in the short term. With the 2.70-2.75 resistance reached today, look for prices to set back near term with 2.60 a likely support level and further weakness to the 2.50 area possible if weather continues to swing cooler.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.