Price Overview

The petroleum complex remained on the defensive, registering sharp losses in response to growing concern over the spread of the Delta variant in China. Prices fell over 3 dollars and reached a low of 65.15 basis September crude before paring losses late in the session on ideas the move was overdone given the potential for OPEC action if demand falls dramatically short of expectations as we move into the fourth quarter. Increased concern is being reflected in flight cancellations, and warning by 46 cities against travel and limits on public transport and taxi services in 144 of the worst hit areas of China. It is interesting to note China’s fuel demand in 2021 is on track to hit record highs on a rebound in car sales and booming domestic air travel. The curbs on travel come just as the summer season peaks, but belief that the restraint will be short-lived might have encouraged short covering and profit taking from the low’s levels registered early in the session.

The strength to Chinese demand will be key in determining valuations in the month ahead given their importance as the world’s number one importer of crude oil. The possible weakening of demand, magnified by the strength to the dollar, has overshadow the rise in Geopolitical tensions in the Middle East and the impasse in negotiations on Iranian sanctions, which have been drawn out more than originally expected. Subsequently OPEC+ might be the key equalizer at a time when the uncertain economic environment remains a prime consideration. Without coordinated support, further weakness toward the 60.00 area could develop.

Natural Gas

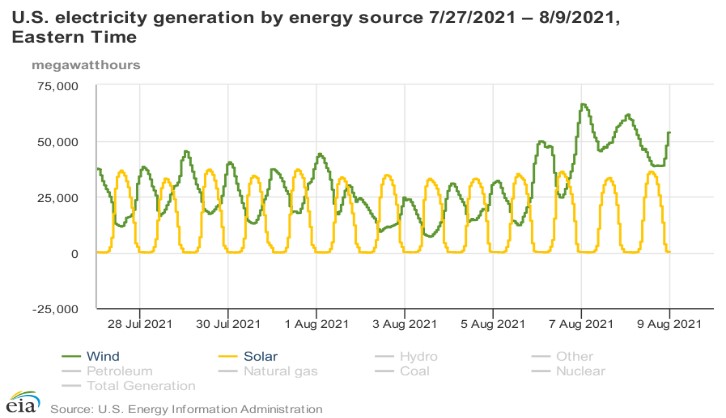

Prices retrenched today as the September contract tested the 4.00 level before settling lower by 8 cents at 4.06. Weather forecasts continue to point to the coming week as being the hottest of the summer, but weekend revisions were mixed as much of the heat may already be priced in. LNG flows added some disappointment, dropping below 10 bcf/d, while power generation from renewables has recently surged to ease gas demand. Macro concerns may have finally had some spillover effect as well, with the petroleum complex coming under significant selling pressure over concerns regarding the spread of the Delta variant and its potential effect on demand in China. Despite the pullback today the market still found good underlying support near the 4.00 level. With production showing minor improvement that level could be tested again near term, but with the overall positive fundamental setup still in place, if the warm forecasts can materialize an extension of the rally could lead to a test the 4.40 level into the second half of the month

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.