Price Overview

The petroleum complex traded sharply higher, registering gains of as much as 2 percent in crude. The rally put values on track for their biggest weekly gain in over a year as energy firms began shutting Gulf of Mexico production ahead of Hurricane Ida early next week. The storm is expected to make landfall in Louisiana and might threaten both oil and gas rigs in the area along with refining facilities, which account for up to 45 percent of US capacity. Support was also provided by indications that the Federal Reserve will move slowly at tapering purchases of financial assets following remarks by Chairman Powell, along with the associated weakness in the dollar as interest rates moved lower. In addition, ideas that economic growth will be supported by the Fed actions along with fiscal stimulus continues to support demand forecasts despite the uptick in the level of COVID infections. OPEC+ discipline at maintaining planned production levels also remains in the background with the September 1st meeting likely to reaffirm their strategy and exert downward pressure on global inventory levels.

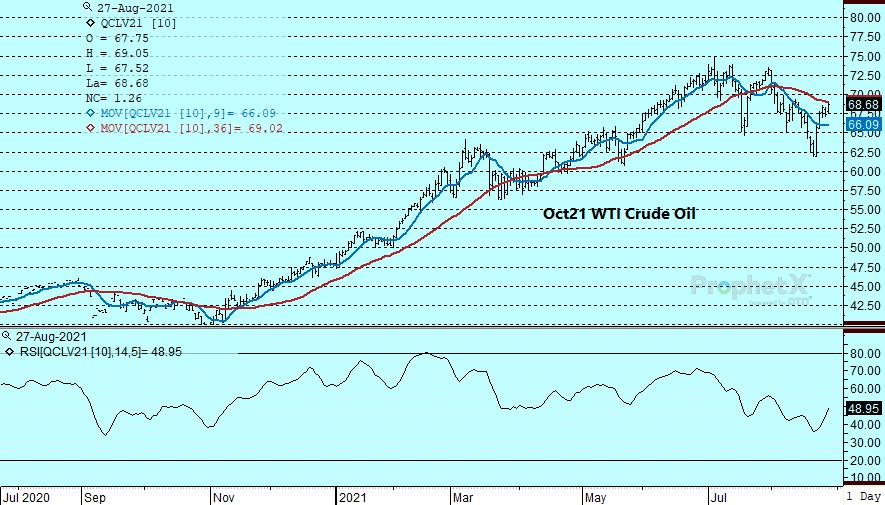

For next week, the impact of the hurricane and the prospect for additional storms might build in a risk premium, helping support values against the 66.00 area basis October crude. With inventory levels well below their five-year averages, forward coverage has gotten progressively tighter and should provide support in advance of the OPEC+ meeting.

Natural Gas

The market exploded to the upside over the last two sessions, gaining 28 cents yesterday and adding another 17 cents today to end the week at 4.388 basis October. The rally was ignited by yesterday’s storage report, which indicated a 29 bcf stock build in contrast to expectations at 40. With the next couple of builds looking to be on the low side, US stocks 6 percent below the 5 year average. and European stocks also in deficit, concern over winter storage levels has ramped up quickly. Adding fuel to the fire is Tropical Storm Ida, which looks to be headed for Gulf production platforms with landfall expected late Sunday at hurricane strenght. Rig evacuations have already started, with output off nearly 1 bcf today. The current track appears to avoid major onshore LNG facilities, but needs to be watched closely as any disruption to export infrastructure would have a much larger effect on demand than the temporary loss of Gulf production would have on supply, as it only accounts for approximately 5 percent of total output. With the “best case scenario” currently being reflected in the market, look for more volatility early next week with a retrenchment likely as the storm makes landfall and attention turns to rainfall totals, power outages and demand destruction

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.