Price Overview

The petroleum complex remained on the defensive following the penetration of support near the 65.00 level basis October yesterday, as values moved down to levels not seen since May. The weakness continues to reflect uncertainty linked to the impact of the spread of the Delta variant on oil demand and global economic prospects. Reports that Japan has extended its lock down, an increase in cases in South Korea, Malaysia, Philippines, Vietnam, and Thailand, along with China imposing new restrictions affecting shipping and global supply chains into 2022 has raised doubts over demand prospects for Asia, a critical oil consumer. Although jet kero remains the weakest link, the seasonal decline in gasoline demand as summer ends is also supporting the bearish case. Fear that the virus will show increasing spread into the Northern Hemisphere winter is also in the background.

Although additional pressure might emerge depending on the trend of infections and whether additional areas of the global economy are closed, the market will continue to watch inventory levels closely. OECD stocks have been declining and are at pre-pandemic levels. The likelihood that consumption will be revised downward suggests that forward coverage is somewhat better than what had been anticipated as stocks decline more slowly along with demand. By no means does it look like the supply/demand situation will be in surplus, but the uncertainty is weighing on values and forcing speculative liquidation. Therefore, we would not be surprised to see prices extend their decline into the 57.50-60.00 area basis October where better support should emerge on the declining stock levels and fear of action by OPEC+ to shore up values. Key to the outlook will be the dollar along with the trends in outside markets in the industrial sector such as copper, as well as the direction of interest rates and Fed policy.

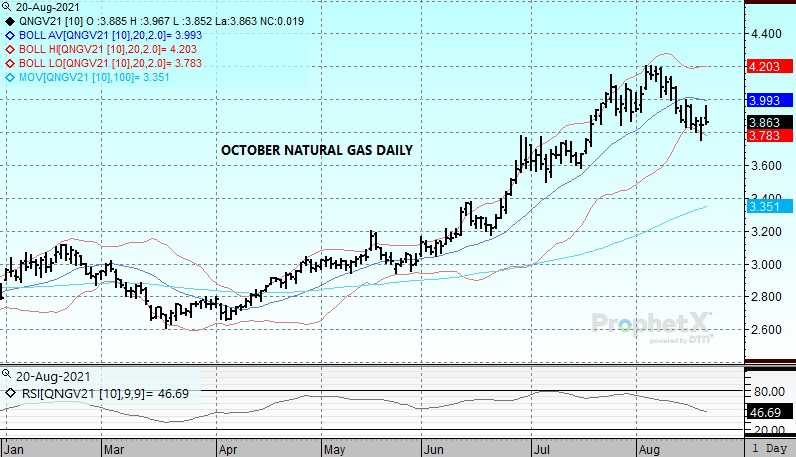

Natural Gas

The market has been on a bit of a roller coaster ride this week with the October probing down to a new low for the move at 3.751 yesterday before bouncing by over 20 cents into the moring session today. Statements from Russia’s Gazprom that they could move as much as 197 bcf of gas this year through the yet to be completed Nord Stream 2 pipeline put extensive pressure on overseas LNG prices, which spilled over into the US market prior to the EIA storage release. When the report came out indicating a much higher than expected 42 bcf implied build, prices put in the lows but have traded higher since the release. Support was offered by upward revisions to afternoon weather model runs yesterday, which were followed up by additional higher revisions this morning. After all was said and done the October settled 2 cents higher at 3.866, less than a penny from where we started the week. For now the market may be settling into in a range between 3.75 and 4.00 as we finish up summer and head into the shoulder season.

Charts Courtesy of DTN Prophet X, EIA, Reuters

The authors of this piece do currently maintain positions in the commodities mentioned within this report.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.