MORNING AG OUTLOOK

Grains are mixed. US stocks are lower. US Dollar is lower. Crude is lower on new demand worries. Gold is higher on uncertainty over US rates outlook.

SH is near 11.82. SH gapped open higher with 12.00 resistance. Soybeans found support due to talk of lower Brazil supply. Brazil harvest near 31 pct. Next 20-30 pct yields could be key if crop is 140 or 156. Most of Brazil, Argentina and Paraguay will be dry. Dalian soybean, soymeal, palmoil and soyoil prices were higher. Soymeal futures are at 1 month high. Brazil soybean export basis is higher on talk that China bought 4-5 soybean cargoes. China pricing may be helping US futures.

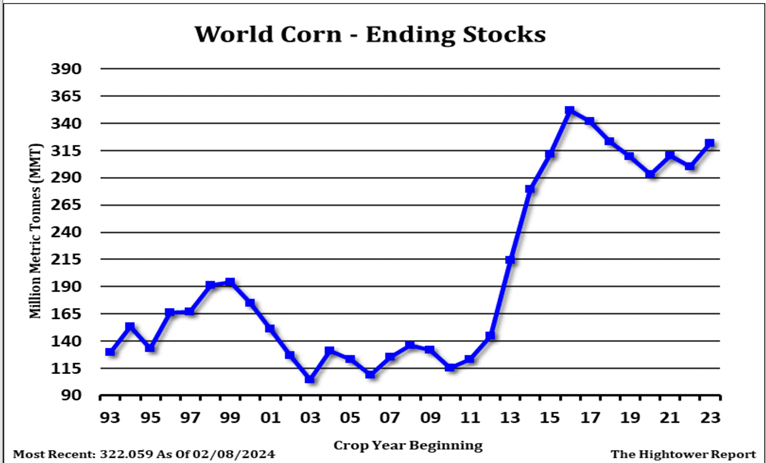

CH is near 4.18. Futures remain oversold. Managed funds near record short corn futures. Some are worried about Brazil monsoon ending and could stress Brazil 2nd crop. One crop watcher estimates Brazil corn crop at 112 mmt vs USDA 124. Brazil est 2nd crop plantings near 59 pct. Indonesia is tendering for corn due to high domestic prices. Black Sea and EU corn prices continues to drop. Most of US Midwest is warm and dry. Dry rest of Feb could raise talk of drier US summer. Cash US corn prices near or below farmer breakeven.

WH is near 5.56. KWH 5.66. MWH 6.49. Could AI momentum machines push WH back near 5.25 2023 low? EU, Russia and Australia wheat prices continue to trend lower. US futures are playing catch up. One group estimates World 2024 wheat crop near 805 mmt vs 785 this past year. Large EU and Russia wheat inventories offers resistance. US plains are dry and warm. Rains are mainly in PNW and E Midwest.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.