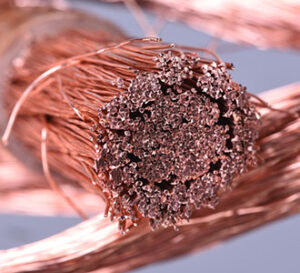

COPPER

With a strong range up breakout to the highest levels since January 31st, the copper market has clearly embraced Chinese copper import data positively. In fact, almost all forms of copper and copper product imports to China increased with January and February copper concentrates and ore reaching the highest seasonal tallies ever. In addition to China’s 2.6% increase in January and February unwrought copper imports, the markets were also reminded of China’s expanded smelting capacity from year ago levels. Obviously, expectations and hopes for a June US rate cut were improved yesterday and another day of soft US economic data today should begin to ratchet up broader market rate cut expectations. We see copper extending toward the January 31st high of $3.9675 especially if the dollar falls further and treasuries rally following today’s round of US jobs related data. We suspect the market will continue to benefit from short covering as last week’s positioning report showed the copper market holding a “net short”.

Chine

Chine

GOLD / SILVER

While the views might be misguided and premature, a segment of the market believes interest rate cuts are likely to rekindle inflation which could be the source of the recent buying frenzy in gold, silver, and Bitcoin. Another bullish catalyst for gold and other physical commodities came from strong Chinese commodity imports which provides hope the Chinese economy is recovering. April gold has continued to surge over the last 48 hours while Bitcoin has seemingly stalled questioning the correlation between the two markets. On the other hand, the dollar index washed out sharply yesterday and is sitting right on its 200 day moving average this morning potentially setting up the beginning of a trend down. US treasuries look to provide more support for gold and silver going forward especially if “any” of today’s US employment related data shows weakness. In short, outside market influences on gold and silver look to be very supportive again today, likely propelling April gold to a contract high and other measures of gold to even higher all-time highs.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.