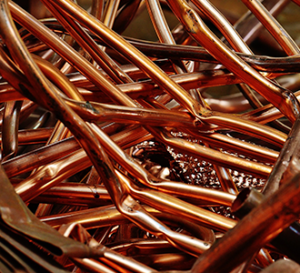

COPPER

The charts in the copper market are damaged with the soft close on Friday and more importantly with the lower low to start the new trading week. In fact, with the copper market short-term overbought from a 5-day $0.18 rally, fresh financial contagion fears in China from the forced liquidation of major property developer Evergrande the outlook for Chinese copper demand is wounded. However, Chinese copper smelters are considering early maintenance because profit margins are extremely tight with treatment charges nearing record lows which in turn typically means lower copper concentrate loadings in March. In other words, signs of tightness in Chinese copper is offset by the news of a failure in the Chinese property sector. However, the copper market remains net spec and fund short with this week’s latest readings clearly overstating the net short because of the nine-cent rally after the report was measured. Fortunately for the bull camp the Chinese have made several stimulus moves over the last two weeks and a portion of the market now expects more action from the Chinese government because of the fresh real estate problems. Unfortunately for the bull camp, there is a developing pattern of inflows to weekly Shanghai copper warehouse stocks.

GOLD / SILVER

With a three-day high and a developing pattern of higher highs and higher lows, the technical picture for gold has improved. However, with a stronger Dollar to start, the positive start in gold and silver might indicate the metals are embracing flight to quality uncertainty from China which saw a major property company forced by a Hong Kong Court to liquidate its assets. Investment interest in gold remains negative with gold ETF holdings last week dropping by 338,377 ounces. However, despite a single day outflow from silver ETF holdings of 1.3 million ounces on Friday, for the week silver holdings increased by 14.2 million ounces. Fortunately for the bull camp in the gold and silver markets, last week’s US inflation data was only modestly higher, and the trade quickly shaped the results into dovish news instead of hawkish views. Even though gold and silver have not responded consistently to flight to quality events, aggression in the Middle East continues to increase with Yemeni terrorists backed by Iranians attacking more ships and launching a drone which killed three US military personnel. Another flight to quality issue surfaced over the weekend following a congressional request for the FBI to investigate Gaza cease-fire protests in the US for possible links to Russia. In another supportive development from last week, Chinese physical gold premiums versus global market prices surged reportedly because of Chinese government stimulus announcements, but it is also possible Chinese investors are seeking refuge from a failure of Evergande especially with real estate reportedly 30% of the Chinese economy.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.