GOLD / SILVER

It would appear as if gold and silver have come through the run-off election and through a wave of softer data from Europe and have retained upward momentum. Fresh downside breakouts in the Dollar and US Treasury bonds give off signals of major change in the structure of the markets with Treasury prices falling below levels seen just before the virus panic surfaced.

PLATINUM / PALLADIUM

The aggressive rallies in the PGM markets yesterday were at least partially if not mostly driven by the arrival of the new virus strain in South Africa with mining operations at the largest producer increasing the threat of disrupted global supply flows. The platinum rally would appear to be fanned by the massive jump in palladium which in turn threatens to push palladium prices back to a larger premium of $1,500 an ounce above platinum prices.

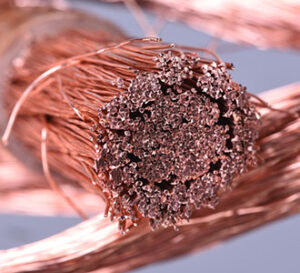

COPPER

With another new high for the move upside breakout on the charts this morning, it is clear that the copper trade has kept its favorable Chinese copper demand views intact despite disappointing Chinese Services PMI readings for December overnight. However, it is also possible that a big picture, broad-based physical commodity price rally is being sparked by reflation buying by hedge funds and speculators.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.